SpaceX's Impact on Satellite Market Trends

Explore how a company revolutionized the satellite market by cutting launch costs, expanding broadband access, and driving industry growth.

SpaceX has reshaped the satellite industry by drastically lowering launch costs and deploying thousands of satellites through its reusable rockets and Starlink project. Here’s what you need to know:

- Cost Reduction: SpaceX’s Falcon 9 reusable rockets have reduced launch costs from $10,000/kg to as low as $2,500/kg, making space more accessible. Launches now cost as little as $62 million compared to competitors charging up to $450 million.

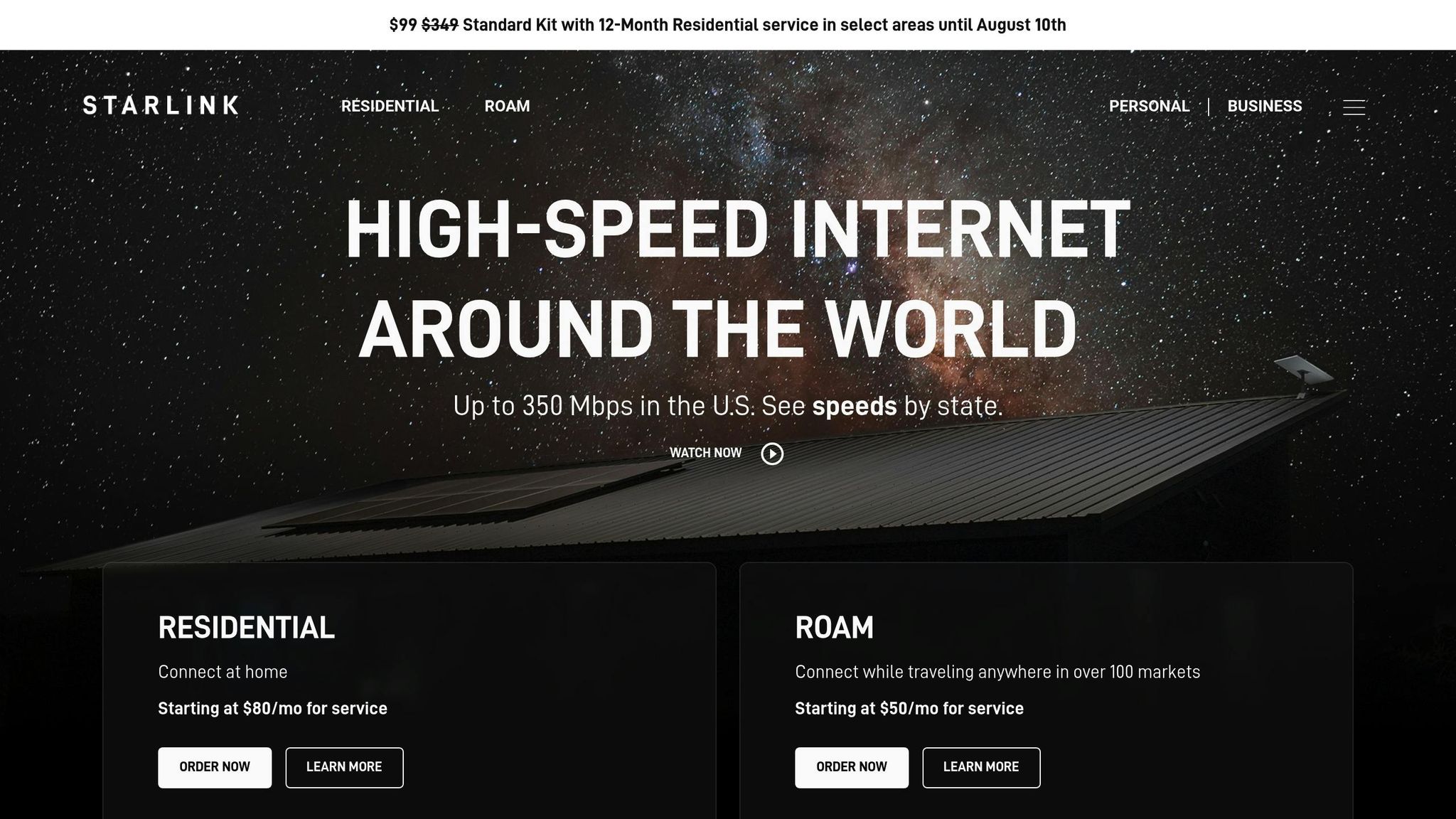

- Starlink Growth: With over 7,000 satellites in orbit and 5.4 million subscribers across 100+ countries, Starlink has become a leader in satellite broadband, delivering speeds of 50-220 Mbps and low latency of 20-30 milliseconds.

- Market Dominance: SpaceX handles 60% of global commercial satellite launches and 95% of U.S. launches, outpacing competitors like OneWeb and Amazon’s Project Kuiper in satellite deployment.

- Revenue Surge: In 2024, SpaceX generated $11.8 billion in revenue, with Starlink contributing $7.7 billion. By 2025, projections estimate $15.5 billion in total revenue.

SpaceX’s advancements are reshaping how satellites are launched, deployed, and utilized, driving down costs, expanding internet access, and influencing global market dynamics.

Starlink Stock: A Trillion Dollar Opportunity

SpaceX's New Satellite Deployment Methods

SpaceX has completely changed the way satellites are sent into orbit, thanks to two major innovations: reusable rockets and mass satellite deployment strategies. These breakthroughs have significantly lowered the cost of accessing space. Let’s take a closer look at how these advancements have disrupted the industry.

Reusable Rockets Slash Launch Costs

The introduction of reusable rockets, like SpaceX's Falcon 9, has been a game-changer. Traditionally, rockets were single-use, high-cost machines that were discarded after each launch. SpaceX flipped the script by engineering boosters capable of returning to Earth, being refurbished, and flying again.

The financial impact is massive. Launching a reusable Falcon 9 costs $67 million, compared to $160 million for a disposable ULA Atlas V rocket. Refurbishing a Falcon 9 booster costs just 10% of building a new one. SpaceX has even offered launches for as low as $62 million, and the marginal cost of reusing a booster could dip to $30 million.

The technology has proven reliable, with Falcon 9 achieving a booster landing success rate of over 97% as of 2024. One booster has even completed 18 missions, demonstrating that extended reuse is not only feasible but also profitable.

This reliability and cost efficiency have attracted major customers. NASA saved over $500 million on its Crew Dragon program by opting for reusable Falcon 9 boosters. The U.S. Space Force has also reaped the benefits, cutting military satellite launch costs by more than 30%. Additionally, over 80% of satellite operators now prefer reusable rockets, with insurance costs for these launches being 25–40% lower than for disposable rockets. These advantages have helped SpaceX secure more than 60% of the global commercial launch market.

Transforming Satellite Deployment with Mass Launches

SpaceX’s approach to satellite deployment has redefined how networks are built. Instead of launching a single large satellite per mission, SpaceX sends up dozens of smaller satellites at once, dramatically lowering costs while accelerating deployment timelines.

The Starlink project is a prime example of this strategy in action. SpaceX deploys satellites at a staggering rate of 1,200 per year, far outpacing competitors like Amazon’s Project Kuiper (400 per year) and OneWeb (600 per year). This rapid deployment capability has reshaped the satellite market, driving down costs and boosting demand .

To make this possible, SpaceX has optimized its satellite design. Starlink satellites feature a compact, flat-panel design that minimizes space requirements, allowing for dense stacking on each launch. This efficiency isn’t limited to Starlink; in January 2021, SpaceX launched 143 small satellites on a single Falcon 9, breaking the previous record of 104 set by India in 2017.

SpaceX also offers rideshare options, allowing multiple payloads to share a single launch. This approach has made space more accessible and affordable for smaller organizations. The small satellite market is booming as a result - Euroconsult predicts about 26,104 small satellites (under 500 kg) will be launched between 2023 and 2032.

Additionally, SpaceX’s ability to launch its own satellites gives it a unique edge. Starlink satellites can be updated with the latest technology, outpacing competitors who depend on third-party launch providers. McKinsey reports that the cost of launching to low Earth orbit (LEO) has dropped from $65,000/kg to just $1,500/kg, fueling a surge in applications like Earth observation and communications.

Looking ahead, SpaceX’s Starship promises even greater efficiency. Each Starlink V3 launch on Starship is expected to add 60 terabits per second of network capacity - more than 20 times the capacity of V2 Mini launches on Falcon 9. This leap in efficiency could redefine what’s possible for satellite constellations, pushing boundaries even further.

Market Changes: Pricing and Demand Shifts

SpaceX has completely transformed the economics of the space industry with its groundbreaking approach to satellite deployment. By slashing costs and advancing technology, the company has not only attracted new customers but also reshaped how governments and businesses think about satellite services. These cost savings are changing the game, influencing both budgets and market entry plans.

Lower Costs Open New Markets

SpaceX has made satellite launches far more affordable. Its pricing, as low as $2,720 per kilogram, is a massive drop compared to traditional rates of $10,000–$25,000 per kilogram - a reduction of up to 70%.

A big factor in this cost efficiency is SpaceX's reusable rocket boosters, which save around $15 million per launch compared to disposable rockets. These savings ripple through entire satellite programs, with over 80% of satellite companies now opting for reusable vehicles.

The numbers speak for themselves. SpaceX's GTO (Geostationary Transfer Orbit) launches cost about $50 million per payload, while competitors charge closer to $250 million for similar missions. This pricing advantage has opened doors to markets that were previously out of reach for many players.

Rising Consumer and Business Demand

The satellite broadband market has seen explosive growth, driven primarily by SpaceX's Starlink constellation. In 2024, satellite broadband internet revenues jumped nearly 30%, reaching $6.2 billion. Projections show the market growing from $13.5 billion in 2025 to $32.86 billion by 2030, with an annual growth rate of 18.16%.

Starlink has become a leader in North America, handling 60% of the region's satellite broadband traffic in 2024. This reflects the increasing demand for dependable internet in underserved areas, especially rural and remote locations.

The broader satellite services market is also reaping the benefits of better accessibility. Global satellite services revenues reached approximately $108.3 billion in 2024, with managed connectivity services - such as maritime and aviation communications, as well as Internet of Things (IoT) applications - growing by 23% to about $9 billion.

The overall space economy hit $415 billion in revenue in 2024, with commercial satellite activities making up 71% of that total, or $293 billion. This boost has been fueled by a sharp rise in operational satellites, which soared from 3,371 in 2020 to 11,539 by the end of 2024.

Government investments have also surged. Global government space spending reached a record $135 billion in 2024, with defense-related projects accounting for 54% of that amount.

SpaceX vs Other Satellite Companies

As demand continues to grow, SpaceX's pricing strategy has set it apart from its competitors. In 2024, the company handled 95% of the 145 U.S. launches, completing 138 missions that year and another 85 missions in 2025. No other company comes close to matching this pace.

A quick look at the numbers explains why SpaceX dominates:

| Launch Provider | Cost per Launch | Cost per kg to Orbit |

|---|---|---|

| SpaceX Falcon 9 | $62–67 million | $2,720 |

| ULA Atlas V | $110–160 million | $10,000–25,000 |

| ULA Delta IV Heavy | ~$450 million | $10,000–25,000 |

| Ariane 5 | ~$185 million | $10,000–25,000 |

Traditional aerospace giants are struggling to keep up with SpaceX's combination of lower prices and frequent launches.

"There's nobody else that's demonstrating launch cadence and reliability other than SpaceX and us", said Peter Beck, Rocket Lab founder and CEO.

"Things are changing in many ways…it's a very dynamic business to be operating in right now, and a really exciting time", said Mark Peller, ULA's senior vice-president for the Vulcan program.

Looking ahead, SpaceX's upcoming Starship system could disrupt the market even further, with projected launch costs between $2–10 million. If achieved, these prices could make satellite deployment so affordable that entirely new industries and applications might emerge.

The impact of SpaceX's cost reductions extends beyond launches. Companies with complementary technologies are thriving due to SpaceX's frequent and affordable launches, creating a broader ecosystem of space-related businesses. Meanwhile, the industry is shifting toward smaller, cheaper satellites and more frequent missions - forcing competitors to adapt or risk falling behind.

For those interested in SpaceX's market influence, the SpaceX Stock Investment Guide offers resources on how to invest in SpaceX and Starlink stocks before their IPO, providing insights into the company's valuation and private equity strategies.

Financial Results: Revenue and Growth Numbers

SpaceX has shifted from being solely a space transportation provider to a diversified operator with multiple revenue streams, thanks largely to the growing impact of Starlink. This transformation has significantly altered the company’s business model and strengthened its market position.

Revenue and Profit Data

SpaceX’s financial performance has been nothing short of impressive. In 2024, the company reported $11.8 billion in revenue, with projections suggesting this could rise to $15.5 billion in 2025. A substantial portion of this comes from Starlink, which generated $7.7 billion in 2024 and is expected to hit $11.8 billion in 2025, making up around 80% of SpaceX’s total revenue.

Starlink’s subscriber base plays a big role in these numbers. By 2025, the service is projected to have 7.8 million subscribers across 125+ countries, including 4.4 million residential customers who contribute roughly $2,000 annually per user. North America leads the way, with 2.5 million subscribers.

Profitability is also on the rise. Starlink’s gross margins climbed from 7% in 2024 to a projected 25% by 2026. By the second quarter of 2025, the service had achieved $2.1 billion in net cash flow, signaling its growing role as a financial powerhouse for SpaceX.

Operational efficiency has been another key factor. In 2024, SpaceX completed 134 launches, with plans for 170 launches in 2025. Impressively, only 6% of Falcon 9 flights used new boosters in 2024, and some rockets were reused up to 24 times in a single year. This high reusability has driven launch costs down to about $30 million per mission, a stark contrast to competitors’ costs of around $80 million.

The maritime and aviation sectors have emerged as lucrative markets for Starlink. In 2024, the service connected 75,000+ vessels, including 300 cruise ships, a sharp increase from 10,000 maritime customers in 2023. These sectors benefit from premium pricing, making them particularly profitable.

These financial achievements highlight SpaceX's robust position and its ability to capitalize on emerging opportunities.

Future Market Projections

The future looks bright for SpaceX and the satellite internet market as a whole. In 2025, Starlink’s revenue grew by 53% to $11.8 billion. The satellite broadband market itself is projected to reach $22.6 billion by 2030, growing at a 13.9% compound annual growth rate (CAGR).

By 2030, Starlink is expected to control 60% of the satellite broadband market, solidifying its leadership. This dominance is supported by SpaceX’s unmatched deployment capabilities. The company currently launches 1,200 satellites per year, outpacing Amazon’s Project Kuiper (400/year) and OneWeb (600/year).

SpaceX’s infrastructure advantage is clear. By mid-2025, the company had deployed 7,950 satellites, with Starlink accounting for 60% of all active low Earth orbit (LEO) satellites. This extensive network creates significant barriers for competitors, giving SpaceX a strong foothold in future market growth.

The company’s valuation reflects its success. In July 2025, SpaceX reached a valuation of $400 billion, making it one of the world’s most valuable private companies. Experts attribute this to SpaceX’s role in what is described as a $1.2 trillion global telecom infrastructure revolution.

Lucas Pleney, a Senior Consultant at Novaspace, captured the essence of SpaceX’s transformation:

"After years of vertical integration, SpaceX is now entering its horizontal integration phase - leveraging its industrial scale and launch dominance to move rapidly into adjacent markets. This shift, from space transportation builder to multi-market operator, is unlocking new revenue streams and reshaping the competitive dynamics in the entire space industry."

Key drivers of growth include the increasing demand for broadband services and the rise of connected vehicles and IoT applications. SpaceX is well-positioned to tap into these trends as Starlink expands into satellite-to-mobile technology and IoT services.

For those interested in investing in SpaceX’s journey, the SpaceX Stock Investment Guide offers resources and insights into private equity strategies and valuation trends ahead of a potential IPO.

Conclusion: Key Points for Investors

SpaceX has reshaped the satellite deployment and connectivity landscape, setting benchmarks in cost efficiency, cutting-edge technology, and strategic growth. Its influence reaches well beyond space exploration, establishing itself as a key player in the global economy and presenting intriguing opportunities for investors.

SpaceX's Market Position

SpaceX has revolutionized the launch industry by slashing costs to just $30 million per mission, a stark contrast to competitors' $80 million price tags. By 2024, the company is projected to command over 85% of the global launch market, a dominance bolstered by the Falcon 9 boosters, which have completed over 450 successful landings and reuses as of May 2025.

Meanwhile, Starlink has secured 60% of the satellite broadband market. This stronghold is further supported by lucrative contracts, such as $5.9 billion from the Pentagon for 28 National Security Space Launch missions by 2025, and a $1.4 billion agreement with the U.S. Space Force in 2024. These achievements cement SpaceX’s role as a cornerstone of the digital economy.

With its unmatched cost efficiencies and market leadership, SpaceX offers a rare, though high-risk, investment opportunity.

Investment Options

The space economy is on an upward trajectory, projected to grow from $630 billion in 2023 to $1.8 trillion by 2035. SpaceX’s valuation of $350 billion as of December 2024 reflects investor confidence in its ability to capitalize on this growth. Starlink alone generates 80% of SpaceX’s revenue, with gross margins expected to hit 25% by 2026.

Investors looking to tap into SpaceX’s growth ahead of a potential IPO should note the challenges of pre-IPO investments, including limited liquidity, regulatory hurdles, and complex transactions. As a private company, SpaceX is not available on traditional stock markets, but its financial momentum is clear. Projections show sales climbing to $13.3 billion and earnings growing 50% to $4.5 billion by 2025.

The satellite broadband market, forecasted to reach $22.6 billion by 2030 with a compound annual growth rate of 13.9%, further underscores the sector’s potential. Investors should conduct thorough research and consider working with specialized dealer-brokers for guidance.

For those wanting to explore SpaceX’s investment potential and pre-IPO strategies, the SpaceX Stock Investment Guide offers resources on private equity investing, valuation trends, and market insights.

SpaceX’s transformation of the satellite market transcends technological breakthroughs - it’s redefining global connectivity and opening new doors for investors. In the words of Gwynne Shotwell, SpaceX’s President and COO:

"Ultimately, I think Starship will be the thing that takes us over the top as one of the most valuable companies."

FAQs

How have SpaceX's reusable rockets helped lower the cost of launching satellites?

SpaceX's approach to using reusable rockets has slashed the cost of satellite launches by an impressive 65% to 70%. Instead of building a new rocket for every mission, they land and refurbish rocket boosters, allowing them to be reused multiple times. This process drastically reduces expenses.

This game-changing method doesn’t just lower costs - it’s opening up space to more players. By making satellite launches more frequent and affordable, SpaceX is reshaping the satellite market and redefining the economics of space exploration.

How could SpaceX's Starship system shape the future of the satellite market?

SpaceX's Starship system is set to shake up the satellite market with its massive payload capacity and dramatically lower launch costs. This game-changing capability could speed up the rollout of mega-constellations and small satellite networks, making space activities more accessible for both commercial ventures and government projects.

Thanks to its frequent and cost-efficient launch potential, Starship is poised to fuel rapid advancements in satellite internet services and other space-based technologies. These developments could significantly grow the satellite market, which is expected to top $22.6 billion by 2025. Starship’s design and capabilities may also inspire fresh deployment strategies, creating a more competitive and dynamic space industry.

What gives SpaceX an edge in the satellite broadband market with its Starlink deployment strategy?

SpaceX has transformed the satellite broadband industry with its Starlink deployment strategy, combining cutting-edge technology with remarkable operational efficiency. Thanks to its reusable Falcon 9 rockets, SpaceX has slashed launch costs to roughly $30 million per mission. This significant cost reduction enables frequent and affordable satellite launches, giving the company a major edge. By mid-2025, SpaceX had deployed an impressive fleet of over 7,950 satellites - far surpassing its rivals.

What truly sets SpaceX apart is its ability to mass-produce satellites and maintain a consistent schedule of weekly launches. This strategy allows for rapid expansion and near-global coverage, boosting the performance of Starlink’s internet services. At the same time, it cements SpaceX’s dominance in the low-Earth orbit satellite market, raising the bar for competitors in terms of reach, capacity, and technological progress.

Comments ()