Secondary Market Insights: Aerospace Sustainability Trends

Explore the transformative trends in aerospace sustainability, where green technologies and regulatory pressures drive market valuations and growth opportunities.

The aerospace secondary market is undergoing a major transformation in 2025, driven by a $103 billion transaction volume in the first half of the year - a 51% increase from 2024. This growth is fueled by rising investor interest in companies prioritizing sustainability, compliance with environmental regulations, and the adoption of green technologies. Key takeaways include:

- Sustainability Boosts Valuations: Companies adopting sustainable aviation fuels (SAF), hydrogen propulsion, and eco-friendly manufacturing are seeing higher valuations.

- Private Equity Dominates: Nearly 75% of aerospace mergers and acquisitions (M&A) involve private equity buyers, focusing on businesses with measurable progress in reducing emissions and adopting alternative fuels.

- Market Leaders: SpaceX leads with a $370 billion valuation, followed by Airbus and Boeing, which are advancing SAF and hydrogen-powered aircraft programs. Lockheed Martin and GE Aerospace are also making strides in green propulsion and materials.

- Regulatory Pressures: Stricter emissions standards and government-backed funding are accelerating the shift toward greener practices.

The secondary market’s shift toward sustainability is reshaping valuations and creating opportunities for growth, particularly for companies aligning with global climate goals.

Can aviation ever be sustainable? Here are some paths to net zero

1. Boeing

Boeing finds itself in the spotlight as investors weigh its efforts to balance environmental responsibility with financial performance. The company's approach to sustainability has become a pivotal factor in shaping its valuation and long-term growth prospects. Below, we delve into Boeing's key sustainability initiatives and their influence on the market.

Sustainability Initiatives

Boeing has pledged to achieve 100% sustainable aviation fuel (SAF) usage by 2030, while also investing in hybrid-electric and hydrogen propulsion technologies. These efforts align with global decarbonization goals set for 2050.

The company has partnered with SAF producers and airlines to conduct test flights powered by sustainable fuels. These collaborations aim to validate the operational feasibility and emissions reductions promised by SAF. Boeing’s work with research institutions and government agencies further cements its role in advancing next-generation green aviation technologies.

Adoption of Sustainable Materials

In addition to advancements in propulsion, Boeing is making strides in material innovation. By focusing on bio-composites, lightweight alloys, and closed-loop manufacturing, the company aims to lower fuel consumption, reduce emissions, and minimize waste - all while boosting operational efficiency.

Boeing’s push for sustainability extends across its supply chain. It now requires suppliers to adopt greener practices, such as using eco-friendly materials and improving transparency. While this fosters stronger relationships with compliant partners, it also creates hurdles for suppliers unable to meet these evolving standards.

Valuation Trends

Boeing’s valuation in the secondary market reflects the broader recovery of the aerospace sector. Notably, its defense contracts are valued at approximately 12x EBITDA multiples for 2025. This premium is tied to the stability and profitability of government contracts, which represent a significant portion of Boeing’s revenue.

Sustainability is becoming a key driver of investor sentiment. Market participants are closely tracking Boeing’s R&D investments in green technologies and its ability to meet ESG (Environmental, Social, and Governance) targets. These factors are increasingly viewed as critical to maintaining long-term market confidence. Private equity interest in Boeing further highlights the growing importance of sustainability in valuation assessments.

Growth Potential

Boeing’s growth prospects hinge on its ability to scale sustainable technologies while navigating regulatory challenges. The aerospace industry is projected to grow 155% by 2035, driven by rising demand for sustainable solutions and fleet modernization efforts.

However, several obstacles could temper this growth. Supply chain disruptions, escalating raw material costs, and geopolitical tensions remain significant challenges. On the flip side, breakthroughs in innovation and government incentives for green technology could accelerate Boeing’s expansion.

Experts surveyed by the World Economic Forum express cautious optimism about Boeing’s role in achieving the aviation sector’s 2030 decarbonization goals. While concerns linger about the pace of SAF adoption and the difficulty of reducing aviation fuel carbon emissions by 5% this decade, regulatory support and technological advancements are seen as vital enablers.

Boeing’s strong footing in the defense sector, bolstered by lucrative government contracts, provides added stability. This segment continues to command higher valuation multiples and serves as a reliable foundation for the company as it scales its sustainability initiatives.

2. Airbus

Airbus has taken a leading role in shaping a more sustainable future for aerospace, setting ambitious goals that are positively affecting its long-term market value. The company's focus on environmental responsibility is drawing significant interest in secondary markets, where sustainability is becoming a major factor in valuation. Let's take a closer look at how Airbus is advancing its technical and environmental initiatives.

Sustainability Initiatives

Airbus is actively pursuing decarbonization through its innovative hydrogen-powered aircraft program. The ZEROe initiative aims to deliver the world’s first zero-emission commercial aircraft by 2035.

In collaboration with energy companies, Airbus is also working to scale the production of sustainable aviation fuel (SAF). The company aims for a 10% SAF blend in all flights by 2030, aligning with broader industry trends. For context, SAF production doubled between 2023 and 2024 and is expected to double again in 2025. Additionally, Airbus is investing in hybrid-electric propulsion systems and aerodynamic advancements to improve fuel efficiency and meet stricter emissions standards.

Adoption of Sustainable Materials

Airbus is reimagining its manufacturing processes by incorporating lightweight composites and bio-composites, which reduce both aircraft weight and environmental impact. This commitment is evident in the A350 and A320neo families, which feature advanced materials and fuel-efficient engines. These innovations contribute to CO₂ emissions reductions of up to 25% compared to older models.

The company is also exploring closed-loop manufacturing systems and prioritizing the sustainable sourcing of raw materials. These efforts aim to minimize waste and improve transparency across the supply chain, driven by both economic pressures and regulatory demands.

Valuation Trends

Airbus’s proactive approach to sustainability has enhanced its appeal in secondary markets, where investors are increasingly drawn to companies with strong ESG (Environmental, Social, and Governance) credentials. Recent data shows that revenue multiples for firms specializing in alternative fuel and eco-efficient aircraft reached up to 4.2x for companies generating $25–100 million in revenue during Q1 2025. The broader aerospace secondary market also hit a record $103 billion in the first half of 2025, with capital inflows and asset pricing at 90% of NAV.

Growth Potential

As demand for eco-friendly air travel grows under stricter emissions regulations, Airbus is well-positioned for long-term growth. Investments in green technologies and sustainable manufacturing will play a crucial role as airlines focus on renewing their fleets. The aerospace and defense M&A market is projected to grow from $218 billion in 2025 to $382 billion by 2030, with a CAGR of 11.86%.

However, achieving these sustainability goals is not without challenges. The high costs and limited availability of SAF, supply chain disruptions for sustainable materials, and the significant R&D investments required remain key obstacles. Airbus is tackling these hurdles by forging partnerships with SAF producers, strengthening supply chain resilience, and collaborating with governments and industry groups to accelerate technological advancements.

A survey conducted by the World Economic Forum highlights that industry leaders and executives view Airbus’s sustainability strategy as a cornerstone of its competitive edge and market resilience.

3. Lockheed Martin

Lockheed Martin blends cutting-edge green technologies with solid financial performance, positioning itself as a leader in sustainability within the aerospace and defense industry. Its focus on environmental responsibility is reshaping its market standing and drawing attention from ESG-focused investors in secondary markets.

Sustainability Initiatives

Lockheed Martin has set ambitious environmental goals, including achieving net-zero operations by 2050 and reducing emissions by 70% from 2015 levels by 2030. These efforts span across its operations and product development strategies.

A key focus area is the development of hybrid-electric propulsion systems for both military and commercial aircraft. These systems significantly cut fuel consumption and emissions. Additionally, the company plays a major role in sustainable aviation fuel (SAF) research consortia, working with industry partners to accelerate the adoption of alternative fuels in the aerospace sector. By investing in SAF technology, Lockheed Martin is well-positioned to meet the growing demand for cleaner aviation solutions as both government and commercial clients increasingly prioritize environmental performance in their procurement decisions. These advancements in green propulsion are setting the stage for transformative changes in manufacturing practices.

Adoption of Sustainable Materials

Lockheed Martin is revamping its manufacturing processes by incorporating lightweight composites and bio-based materials. These materials help reduce aircraft weight, improving fuel efficiency and cutting emissions over the product's lifecycle. The company is also exploring closed-loop manufacturing systems, which include recycling programs aimed at minimizing waste and increasing the use of eco-friendly materials in both new builds and retrofits. Advanced composites and digital engineering technologies are central to these efforts, enabling more efficient design processes and further reducing lifecycle emissions.

Valuation Trends

Lockheed Martin's strong foothold in the defense sector has translated into impressive valuation numbers in secondary markets. Military and defense companies averaged revenue multiples of 3.3x–6x and EBITDA multiples near 12x in Q1 2025. Additionally, the Defense Index, which includes Lockheed Martin, rose by 33.5% in the first half of 2025, outperforming the S&P 500 and other aerospace segments. This surge reflects investor confidence in the company's stable government contracts and its growing emphasis on sustainability. By proactively adopting green technologies and adhering to emerging environmental regulations, Lockheed Martin has maintained investor trust even during periods of market volatility. These strong market metrics highlight the company's resilience and its ability to expand into sustainable growth areas.

Growth Potential

Lockheed Martin's growth is being driven by stricter emissions regulations and incentives for green technology. Its investments in electrification, sustainable materials, and digital technologies position the company to capitalize on these trends. Government support and emerging markets for urban air mobility (UAM) and advanced air mobility (AAM) are further fueling its sustainable expansion, with these sectors expected to play a major role in the future of aerospace. As cities and governments seek cleaner transportation options, these markets present significant opportunities. Lockheed Martin's dual focus on defense and commercial applications, combined with its expertise in advanced materials and energy-efficient systems, gives it a competitive edge in capturing market share across various segments. Strategic collaborations with research institutions, industry groups, and government agencies further strengthen its position in driving green aerospace innovation.

Lockheed Martin’s commitment to sustainability reflects the broader industry shift toward eco-efficient innovations that are increasingly valued by investors.

4. GE Aerospace

GE Aerospace has positioned itself as a leader in sustainable aviation, leveraging advanced propulsion technologies to lower emissions. By combining cutting-edge engine innovations with strategic alliances, the company has become a prominent name in the investment landscape focused on sustainability.

Sustainability Initiatives

GE Aerospace is committed to helping the aviation industry achieve net-zero emissions by 2050. To this end, it is developing fuel-efficient engines and investing in hybrid-electric propulsion systems to reduce carbon emissions. As a member of the Clean Skies for Tomorrow Coalition, the company actively promotes the adoption of sustainable aviation fuel (SAF) across the industry.

Beyond industry coalitions, GE Aerospace collaborates directly with airlines, fuel producers, and research institutions. These partnerships focus on testing SAF blends in commercial engines and working toward standardizing sustainable practices. The company has also joined forces with NASA and other key players to advance technologies that support greener aviation. According to its 2025 Sustainability Report, GE Aerospace has consistently reduced emissions while increasing the number of engines compatible with SAF. This focus on sustainability aligns with its innovations in materials and manufacturing.

Adoption of Sustainable Materials

To enhance fuel efficiency and reduce environmental impact, GE Aerospace incorporates bio-based materials and advanced composites into its manufacturing processes. These materials are used within a closed-loop system that minimizes waste and reduces aircraft weight. The company is also exploring recycling programs aimed at creating a more circular supply chain.

Valuation Trends

GE Aerospace’s strong presence in both commercial and defense markets has led to impressive secondary market valuations. Defense contracts, for example, averaged 12x EBITDA in 2025, significantly higher than the aerospace sector's overall average of about 8x. The company's leadership in sustainable aviation and alignment with global ESG standards have further boosted its valuation. Investors are increasingly drawn to companies with credible decarbonization strategies, often rewarding them with premium valuations. Private equity firms have shown a particular interest in aerospace, accounting for nearly 75% of M&A activity in the sector during the second half of 2023.

Growth Potential

GE Aerospace’s growth potential is bolstered by a combination of favorable trends in the aerospace industry and its operational strengths. The aerospace and defense M&A market is expected to grow from $218 billion in 2025 to $382 billion by 2030, with an annual growth rate of 11.86%. Increasing demand for fuel-efficient engines and the company’s investments in digital solutions - such as predictive maintenance and fuel optimization - are setting the stage for significant expansion. These digital tools not only reduce emissions but also help airlines lower costs, enhancing GE Aerospace’s market appeal.

Investors are particularly drawn to companies that excel in vertical integration and capacity improvements. GE Aerospace’s expertise in propulsion systems, focus on sustainability, and robust defense portfolio make it well-equipped to handle market fluctuations. This combination supports steady cash flows, strong valuations, and sustainable growth in both commercial and defense markets.

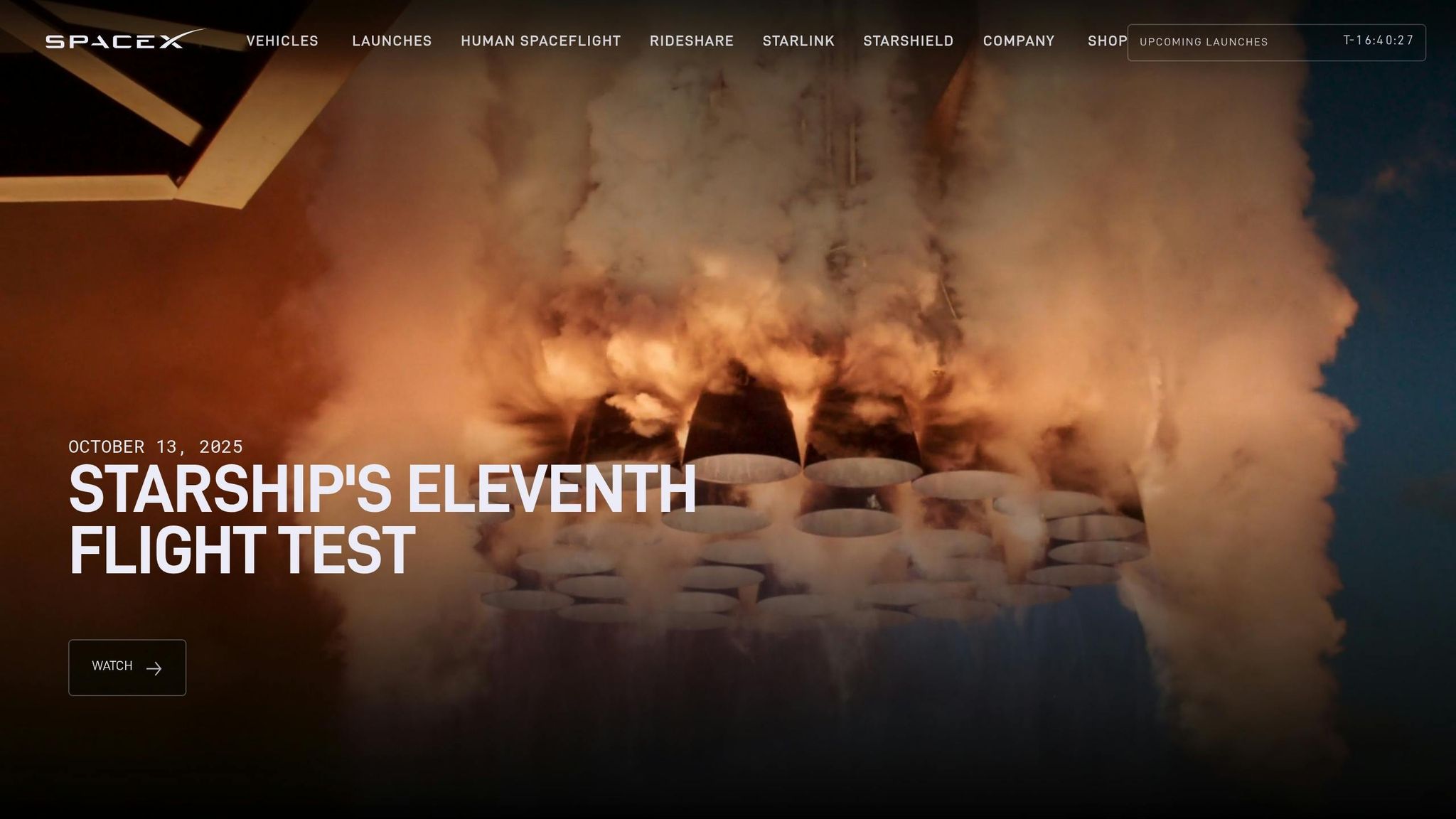

5. SpaceX Stock Investment Guide

SpaceX is reshaping the aerospace industry with its reusable rockets and cutting-edge materials, pushing its valuation to an estimated $370 billion as of February 2025. Alongside industry giants like Boeing and Airbus, SpaceX is aligning itself with sustainability trends, which are playing a key role in driving both growth and valuation. By prioritizing environmentally conscious practices, the company is helping redefine how aerospace firms are valued.

Sustainability Initiatives

At the heart of SpaceX's approach to sustainability is its reusable rocket technology, a game-changer for reducing the cost and environmental impact of space travel. The Falcon 9 reuse program, for instance, slashes both operational costs and emissions. Beyond rockets, the company is investing in efficient manufacturing processes and optimized fuel systems to further minimize its carbon footprint. Another major initiative is the Starlink network, which aims to expand global connectivity while deploying satellites in a more efficient and environmentally responsible manner. These efforts highlight how sustainability is fueling SpaceX's market growth.

Adoption of Sustainable Materials

SpaceX is also making strides in the use of advanced materials. Lightweight composites and alloys are already part of its manufacturing process, and the company is exploring bio-composites within closed-loop systems to further enhance efficiency while cutting down on material waste. This focus on sustainable materials not only strengthens SpaceX's operational efficiency but also appeals to investors who prioritize environmentally conscious companies.

Valuation Trends

SpaceX's valuation in the secondary market has surged, thanks to its leadership in reusable launch technology, the expansion of the Starlink satellite network, and its ventures into commercial space travel. The secondary market for private equity, including SpaceX shares, saw a record $103 billion in transaction volume during the first half of 2025 - a 51% jump compared to the same period in 2024. Additionally, capital dedicated to secondary market transactions hit an all-time high of $302 billion in H1 2025, reflecting strong investor interest in high-growth private companies like SpaceX. Recent transactions have priced SpaceX shares at about 90% of the company’s estimated net asset value, signaling high demand paired with a limited supply of shares. This robust activity underscores investor confidence and sets the stage for continued growth.

Growth Potential

SpaceX is well positioned to capitalize on the aerospace sector's pivot toward sustainable innovation. Strong M&A activity is further enhancing its growth prospects. Combined with its commitment to reusable technology and sustainable materials, SpaceX is poised to secure an even larger share of both commercial and government space markets. Industry analysts predict that ongoing investments in sustainability and cutting-edge technology will not only boost SpaceX’s valuation but also establish new standards for environmental responsibility in the aerospace industry. Of course, challenges remain - like the high development costs of new technologies and regulatory complexities - but SpaceX is addressing these hurdles through significant R&D efforts and close partnerships with suppliers.

For those interested in acquiring SpaceX shares before its IPO, the secondary market remains the primary option, as direct retail access is still limited. The SpaceX Stock Investment Guide provides valuable resources, including detailed insights into valuation trends and strategies for private equity investments, with a focus on sustainability-driven opportunities like SpaceX and Starlink.

6. KLM

KLM made history in 2009 by operating the first commercial biofuel flight, establishing itself as a leader in sustainable aviation. Its parent company, Air France-KLM, further demonstrated its commitment to reducing environmental impact by achieving a 7% reduction in CO₂ emissions per passenger-kilometer in 2024 compared to 2019. These milestones highlight KLM's dedication to greener aviation.

Sustainability Initiatives

KLM is actively working toward a more sustainable future by focusing on two key strategies: adopting sustainable aviation fuel (SAF) and modernizing its fleet. The airline has pledged to use at least 10% SAF on all flights departing from Amsterdam Schiphol by 2030. Additionally, it aims to cut CO₂ emissions per passenger by half by 2030 compared to 2005 levels. KLM also collaborates with global initiatives like the Clean Skies for Tomorrow coalition to accelerate the journey to net-zero aviation. Its partnerships with fuel suppliers, aircraft manufacturers, and research organizations are driving advancements in decarbonization.

Adoption of Sustainable Materials

To improve fuel efficiency and lower emissions, KLM is integrating lightweight composite materials into its aircraft. The airline is also exploring bio-composites and closed-loop manufacturing systems, which aim to reduce waste during production and maintenance. These efforts not only enhance operational efficiency but also reflect a broader industry push toward innovation in materials and waste management.

Valuation Trends

KLM's commitment to sustainability is becoming a key factor in its market valuation. Investors are increasingly drawn to its strong environmental, social, and governance (ESG) performance, even as challenges like high SAF costs and supply chain disruptions create volatility. Early investments in green initiatives and clear net-zero commitments have positioned KLM as a preferred choice for both investors and regulators.

Growth Potential

KLM's future growth hinges on its ability to innovate in sustainability and navigate evolving regulations. The airline's fleet renewal program aims to deliver a 20% improvement in fuel efficiency by 2028, aligning with its environmental goals while cutting operational costs. As demand for eco-conscious travel grows and governments enforce stricter emissions standards, KLM's investments in green technologies, government partnerships, and industry collaborations are expected to strengthen its market position. Experts predict that airlines prioritizing sustainability will gain competitive advantages and inspire greater investor confidence as the industry transitions to net-zero.

Company Comparison: Strengths and Weaknesses

The aerospace industry's growing focus on sustainability is reshaping the secondary market, dividing companies into leaders and laggards. How a company addresses environmental challenges is now a key factor influencing investor confidence and market valuation.

Defense contractors like Lockheed Martin and Boeing's defense division enjoy EBITDA multiples of around 12x, significantly higher than the 8x average seen in other aerospace sectors. This premium stems from the reliability of government contracts and the critical nature of their offerings, which remain less affected by sustainability metrics.

Boeing presents a mixed picture when it comes to sustainability. Its ecoDemonstrator program explores green technologies under practical conditions, but delays in rolling out these advancements create uncertainty. While Boeing's defense business continues to show strong valuations, its commercial division faces mounting pressure to fulfill its sustainability commitments.

Airbus leads the way in sustainability with its ambitious ZEROe hydrogen aircraft project and advancements in electric propulsion technologies. The company’s transparent ESG reporting and its pledge to achieve net-zero emissions by 2050 have attracted investors prioritizing environmental responsibility. However, like Boeing, Airbus must address the challenge of scaling production to meet the rising demand for sustainable aircraft, which could impact short-term growth.

SpaceX, valued at approximately $370 billion as of February 2025, occupies a unique position in the market. Its reusable rocket technology, with over 200 successful launches, has set new benchmarks for reducing waste and cutting costs. However, the company faces scrutiny due to limited ESG disclosures, a factor that could affect investor trust as transparency standards tighten.

Here’s a snapshot of key sustainability metrics and market standings:

| Company | Net-Zero Target | Key Sustainability Metric | Secondary Market Position | Primary Challenge |

|---|---|---|---|---|

| Boeing | 2050 | Broad SAF partnerships | Strong defense multiples (~12x) | Technology rollout delays |

| Airbus | 2050 | 100+ SAF-compatible aircraft delivered | Moderate multiples (3.3x–4.8x) | Scaling production capacity |

| Lockheed Martin | Not specified | Sustainable manufacturing focus | Highest multiples (~12x) | Limited commercial sustainability |

| GE Aerospace | 2050 | LEAP engine efficiency gains | Moderate growth potential | Airline adoption dependency |

| SpaceX | Not specified | 200+ reusable launches | $370B private valuation | Insufficient ESG disclosure |

| KLM | 2030 (50% reduction) | 10% SAF target by 2030 | Lower airline multiples | Challenges in scaling operations |

GE Aerospace stands out for its LEAP engine technology, which delivers notable fuel efficiency improvements and has been widely adopted across the industry. While the company benefits from being a key supplier to major aircraft manufacturers, its growth heavily depends on airlines' readiness to invest in efficient engines, especially during uncertain economic times.

KLM has made early strides in adopting sustainable aviation fuel (SAF) and reducing carbon emissions. By 2024, the airline achieved a 7% reduction in CO₂ emissions per passenger-kilometer compared to 2019 and committed to using 10% SAF on all Amsterdam departures by 2030. However, KLM faces the usual hurdles of the airline industry, including lower valuation multiples and the challenge of scaling sustainable practices fleet-wide.

Revenue multiples for private aerospace companies in Q1 2025 highlight clear investor preferences: Military & Defense companies lead with multiples between 3.3x and 6x, while Alternative Fuel firms range from 2.1x to 4.2x, and Space Tourism businesses fall between 2.2x and 5.1x. These figures reflect a strong preference for companies offering distinct advantages in their respective niches.

Cross-border M&A activity surged by 27% in Q1 2025, driven by demand for specialized technologies and ISR platforms. Strategic buyers accounted for 71% of aerospace M&A deals, focusing on building capabilities and integrating vertically. Companies with strong environmental strategies and technological differentiation are well-positioned to benefit from this trend.

Private equity is also playing an increasingly dominant role, making up nearly 75% of aerospace buyers in H2 2023. This buy-and-build strategy favors businesses that combine environmental responsibility with operational efficiency.

For those interested in private aerospace investments, the SpaceX Stock Investment Guide offers insights into private equity strategies and valuation trends for companies like SpaceX and Starlink ahead of potential IPOs. This comparison underscores how sustainability metrics are becoming a critical driver of secondary market valuations in the aerospace sector.

Conclusion

Sustainability is now a key factor shaping valuations in the aerospace secondary market. Companies at the forefront of environmentally conscious innovation are not only commanding higher valuations but also drawing increased interest from investors.

Airbus is leading the charge with its advancements in hydrogen-powered aircraft and alternative fuels. Meanwhile, Boeing, though showing potential with its ecoDemonstrator program, faces hurdles in scaling its initiatives effectively. On another front, the defense sector remains a standout performer. Firms like Lockheed Martin are achieving EBITDA multiples around 12x - well above the 8x average in other aerospace segments. This premium reflects the stability provided by government contracts and the critical nature of defense operations, which are less influenced by sustainability factors.

In the space sector, SpaceX continues to set the bar high with a staggering $370 billion valuation. The company's focus on reusable rocket technology has redefined expectations for both cost efficiency and environmental responsibility, proving that sustainable practices can directly boost market confidence.

The secondary market itself is thriving, with transaction volumes hitting record highs in the first half of 2025. Private equity firms now dominate, accounting for nearly 75% of aerospace acquisitions. These firms are increasingly favoring companies with strong environmental credentials, aligning with broader market trends.

Looking ahead, the aerospace M&A market is expected to grow from $218 billion in 2025 to $382 billion by 2030, reflecting a compound annual growth rate of 11.86%. Companies focused on alternative fuels, hybrid-electric propulsion, and advanced materials are poised to capture a larger share of this expanding market.

For investors, this intersection of sustainability and market growth presents a wealth of opportunities. Companies like GE Aerospace, with its focus on fuel-efficient engines, and startups such as Electra.aero, which secured $115 million in Series B funding in April 2025 for hybrid-electric aircraft, exemplify the potential for strong returns in this evolving landscape.

As these trends gain momentum, investors who align with sustainability-focused leaders early are likely to reap the rewards. For those exploring private aerospace opportunities, resources like the SpaceX Stock Investment Guide offer valuable insights, particularly as companies like SpaceX and Starlink move closer to potential public offerings. In this new era, sustainability is not just a competitive edge - it’s becoming the cornerstone of long-term success in the aerospace secondary market.

FAQs

How are private equity firms driving sustainability trends in the aerospace secondary market?

Private equity firms are making waves in the aerospace secondary market by championing sustainability. They're channeling their investments into businesses that emphasize eco-conscious technologies, renewable energy adoption, and strategies to cut carbon emissions. In doing so, these firms are not only influencing the industry's direction but also setting the stage for a greener future.

This focus on sustainability is also impacting company valuations. Businesses with robust green initiatives often show stronger growth potential and draw more attention from investors. As the push for environmentally friendly aerospace solutions intensifies, private equity is playing a key role in speeding up the industry's shift toward sustainability.

What obstacles do Boeing and Airbus face in adopting and scaling sustainable aviation technologies?

Boeing and Airbus are navigating a tough path as they work to scale up sustainable aviation technologies. One of the biggest hurdles? The steep costs tied to research and development. Creating alternative fuels and designing eco-friendly aircraft isn’t just expensive - it’s also a long-term process before these innovations can be rolled out commercially. On top of that, retrofitting current aircraft fleets to align with sustainability goals demands a hefty financial commitment and careful logistical planning.

Another significant roadblock is the lack of infrastructure to support sustainable aviation fuels (SAFs) on a large scale. Right now, many airports and supply chains simply aren’t set up to handle widespread SAF distribution. Add to that the challenge of navigating regulatory differences and emissions standards across countries and regions, and it becomes clear just how complex this effort is for manufacturers.

Even with these obstacles, Boeing and Airbus are doubling down on green technologies, showing a clear determination to push aviation toward a more sustainable future.

How do sustainable aviation fuels (SAF) influence the valuation of aerospace companies in the secondary market?

Sustainable aviation fuels (SAF) are gaining traction in the aerospace industry as companies work toward reducing carbon emissions and meeting sustainability goals. Incorporating SAF into operations not only helps minimize environmental impact but can also boost a company's standing in the secondary market. A stronger reputation, compliance with global environmental regulations, and appeal to eco-conscious investors are just some of the benefits.

Companies that take the lead in developing or integrating SAF are also well-positioned for growth. With demand for greener aviation solutions on the rise, these firms may enjoy a competitive edge. That said, the influence of SAF on valuations depends on several factors, including production costs, scalability, and how widely the market embraces these fuels.

Comments ()