Satellite Internet Expansion: Key Investment Insights

Rapid satellite internet growth reshapes global broadband — high revenue potential, regulatory and operational risks, and complex pre-IPO investment trade-offs.

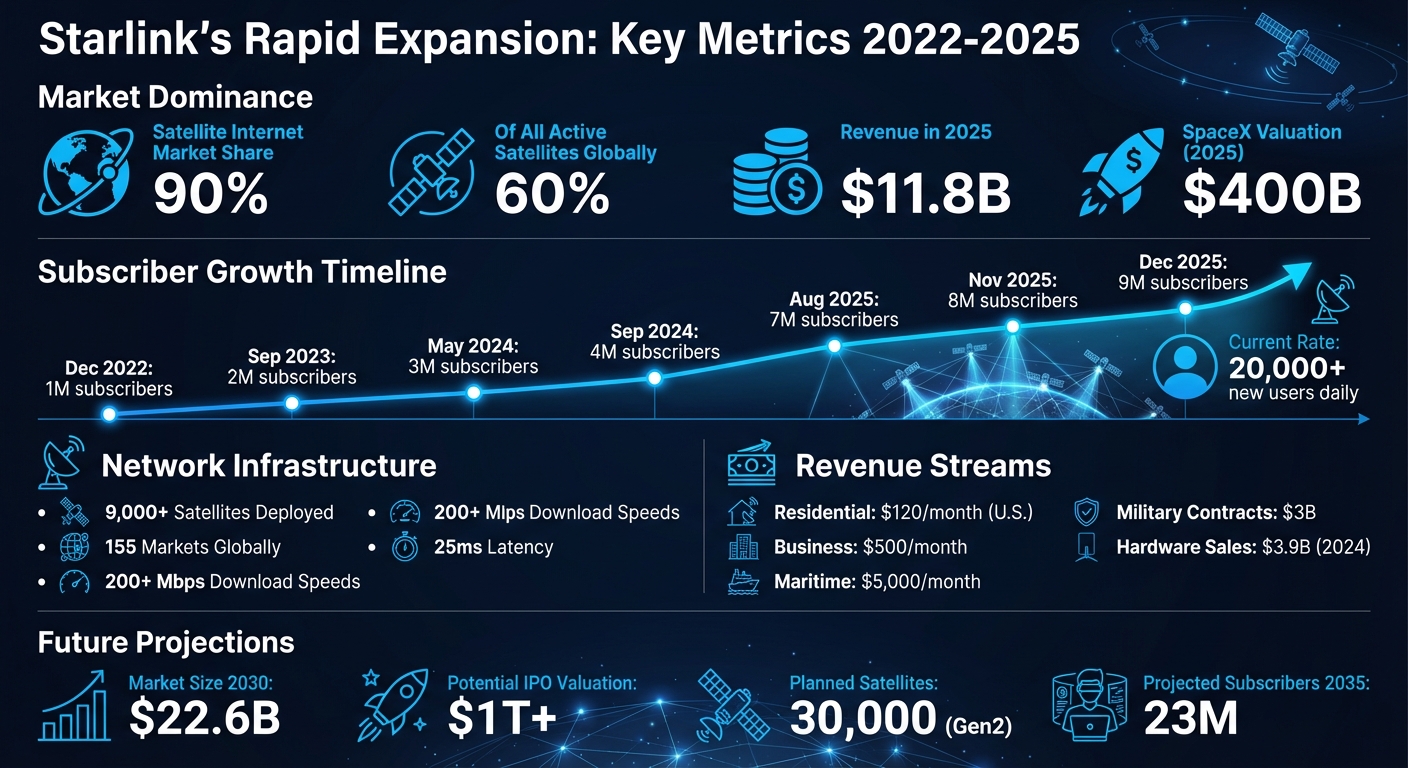

Starlink, SpaceX’s satellite internet service, has become a major player in global connectivity, generating $11.8 billion in revenue by 2025. With over 9 million subscribers and 8,000+ satellites in orbit, it has reshaped internet access, especially in underserved regions. Offering speeds over 200 Mbps and latency as low as 25ms, Starlink rivals traditional broadband services.

Key Highlights:

- Market Dominance: Starlink holds 90% of the satellite internet market and operates 60% of all active satellites.

- Subscriber Growth: Rapid expansion from 1M users in 2022 to 9M by late 2025, adding 20,000+ users daily.

- Revenue Streams:

- Residential plans: $120/month (U.S.), GDP-based pricing globally.

- Enterprise contracts: Maritime services ($5,000/month), airline Wi-Fi deals, and government contracts ($3B from the U.S. military).

- Direct-to-Cell (DTC) technology: Partnerships with T-Mobile, Reliance Jio, and others.

- Future Expansion: Plans to grow its Gen2 network to 30,000 satellites and introduce Starship launches for larger satellites.

Challenges:

- Regulatory hurdles, spectrum allocation, and geopolitical risks.

- Rising competition from Amazon’s Project Kuiper and government-backed constellations.

- Operational strain due to satellite replacements and network congestion fees.

Investment Outlook:

Starlink’s growth aligns with a booming satellite internet market, projected to reach $22.6 billion by 2030. SpaceX’s valuation hit $400 billion in 2025, with a potential IPO in 2026-2027, possibly valuing the company at $1 trillion or more. However, risks include regulatory delays, Starship development uncertainties, and competition.

For investors, Starlink offers high-reward potential but requires careful consideration of risks and long-term commitment. For those ready to proceed, understanding how to buy SpaceX stock is the first step.

Starlink Growth Metrics and Market Dominance 2022-2025

Starlink's Growth and Market Impact

Subscriber Growth and Milestones

Starlink's growth in subscribers has been nothing short of explosive. By December 2025, the service had reached 9 million active customers worldwide, with the latest million subscribers added in under seven weeks. On average, Starlink is now gaining over 20,000 new users daily.

The timeline of Starlink's subscriber growth is impressive. After hitting 1 million users in December 2022, it surged to 2 million by September 2023, 3 million by May 2024, and 4 million by September 2024. By August 2025, the count had soared to 7 million, climbing to 8 million in November 2025 and 9 million just a month later. To put this into perspective, legacy providers like Hughes took eight years to reach their first million subscribers.

Starlink now operates in 155 markets globally, covering areas from North America to emerging regions across Africa, South America, and Asia. In the U.S., the service is the seventh-largest fixed internet provider, with about 2.6 million subscribers as of November 2025. Beyond residential users, Starlink is making headway in niche markets. For instance, it has secured deals with around two dozen airlines for in-flight Wi-Fi and is seeing significant adoption in the maritime sector, with many vessels trialing the service.

Interestingly, Starlink isn't merely pulling customers from competitors - it’s expanding the overall market. Brent Prokosh, an industry consultant at Euroconsult, highlighted this trend:

"This is clear evidence of the pie absolutely growing because of Starlink, as opposed to just drawing from established business of other operators".

Australia offers a clear example of this market expansion. Starlink has amassed 120,000 subscribers there, while the incumbent NBN saw minimal customer losses, reinforcing the idea that Starlink is attracting new users rather than simply redistributing existing ones. This rapid subscriber growth is matched by an equally ambitious satellite deployment strategy.

Satellite Launches and Deployment Plans

Starlink's satellite network has expanded rapidly alongside its growing user base. By late December 2025, SpaceX had deployed over 9,000 satellites, up from 8,861 just a month earlier. Since its first prototypes launched in 2018, the company has sent more than 10,000 mass-produced satellites into orbit.

Currently, SpaceX uses Falcon 9 rockets to launch 28–29 V2 Mini satellites per mission. However, starting in 2026, SpaceX plans to transition to its Starship vehicle, which will carry approximately 60 larger V3 satellites per launch. In 2025 alone, the company hit a remarkable launch cadence of 15 missions per month, made possible by Falcon 9 boosters now certified for up to 40 flights each.

Starlink is also scaling its "Direct to Cell" initiative, having launched over 650 specialized satellites within 18 months. This system aims to provide mobile connectivity directly to standard smartphones through partnerships with carriers like T-Mobile, Rogers, and Optus. Additionally, the company is lowering its satellite orbits to altitudes of 340–365 km, reducing latency to under 20 milliseconds and enabling gigabit speeds that rival terrestrial fiber networks.

Looking ahead, SpaceX is seeking regulatory approval to expand its Gen2 network to nearly 30,000 satellites, signaling that its infrastructure growth is far from slowing down.

Investment Opportunities and Revenue Potential

Revenue Streams from Satellite Internet

Starlink has transformed from an ambitious experiment into SpaceX’s primary moneymaker, even surpassing its rocket launch revenue for two years in a row as of 2025. This success comes from multiple income streams, creating a well-rounded business model.

At its core are consumer broadband subscriptions. Pricing varies by region, tailored to local markets. In the U.S., residential plans cost $120 per month with a $599 hardware fee, while business plans are priced at $500 monthly with a $2,500 equipment cost. To expand globally, Starlink uses GDP-based pricing, charging as little as $24 per month in countries like Zambia. In 2024 alone, hardware sales brought in $3.9 billion.

The company is also making strides in high-margin enterprise contracts. For example, in October 2023, Maersk announced plans to outfit its fleet of over 330 ships with Starlink terminals, with completion expected by early 2024. Similarly, Qatar Airways partnered with Starlink to offer free high-speed Wi-Fi across its fleet, solidifying the company’s foothold in premium markets. Maritime services command a hefty $5,000 monthly fee and a $10,000 hardware cost.

Government and military contracts are another key revenue source. Starshield, the division focused on encrypted communications for government use, became Starlink’s second-largest revenue contributor by 2024. The company has secured around $3 billion in U.S. military contracts, providing what SpaceX calls the “steady and predictable” income needed to prepare for a potential IPO.

Direct-to-Cell (DTC) technology adds yet another dimension. In July 2025, T-Mobile launched its "T-Satellite" service using Starlink’s DTC tech, later extending access to Verizon and AT&T customers to eliminate mobile dead zones across North America. Additionally, in March 2025, Starlink signed a groundbreaking deal with Reliance Jio to tap into India’s vast connectivity market.

This diverse revenue base positions Starlink for sustained growth and global market expansion.

Market Size and Growth Projections

Starlink’s expanding revenue streams align with broader trends in the satellite internet market. Globally, the market was valued at $10.4 billion in 2024 and is expected to grow to $22.6 billion by 2030, reflecting an annual growth rate of 13.9%. Meanwhile, the broader satellite industry could grow from $15 billion to $108 billion by 2035, with optimistic projections reaching as high as $457 billion.

Starlink’s financial outlook mirrors this trajectory. The company’s revenue is forecasted to grow at a 27% annual rate between 2023 and 2035. Subscriber numbers are expected to hit 23 million by 2035, with a potential increase to 32 million by 2040. Gross margins are climbing rapidly, from 7% in 2024 to an anticipated 25% by 2026. By 2026, the company aims to break even on EBITDA and turn free cash flow positive by 2027.

SpaceX’s cost efficiencies give Starlink a significant edge. By reusing Falcon 9 boosters up to 29 times, the company has slashed launch costs by 70%, bringing them down to $30 million per mission compared to competitors’ $80 million. This efficiency has reduced the cost per kilogram to orbit from $10,000 to $2,500, with future Starship goals targeting just $10/kg. These savings allow for rapid network expansion without sacrificing profitability.

The potential market for satellite internet remains enormous. Around 2.5 billion people worldwide still lack internet access, presenting a vast opportunity. Allen Chang, Head of Greater China Technology Research at Goldman Sachs, commented:

"We think there is good potential for LEO satellites to become a mainstream technology, affecting traditional telecom companies both negatively and positively".

With these market dynamics and Starlink’s cost advantages, analysts suggest the company could go public in 2027 with a valuation exceeding $600 billion. Current estimates imply a revenue multiple of 34x - on par with software companies rather than traditional telecom providers like AT&T, which trades at roughly 8x.

Risks and Challenges for Investors

Regulatory and Compliance Risks

Starlink’s global expansion faces significant regulatory obstacles. SpaceX must navigate a labyrinth of requirements, including landing rights, service licenses, and ground station gateway approvals in every country it enters. This process is notoriously slow, driven by concerns over national sovereignty and cybersecurity. As of late 2023, Starlink operates in roughly 40 countries, underscoring the sluggish pace of regulatory approvals.

Spectrum allocation presents another major challenge. SpaceX must coordinate with the ITU and national regulators to ensure frequencies are shared and interference is avoided. On top of that, data sovereignty laws, such as the EU's GDPR and the US Patriot Act, add layers of complexity to compliance efforts. The Boston Consulting Group aptly summarized the situation:

"the biggest challenge to unleashing the potential of LEO satellite technology is from government regulations".

Space debris regulations are tightening as well. For instance, the US FCC now requires satellites to be removed from orbit within five years of completing their mission. Given Elon Musk’s ambitious plan to deploy up to 42,000 satellites, this adds a continuous compliance burden. Starlink’s dual-use nature - serving both civilian and military applications - raises additional concerns about potential weaponization. SpaceX President Gwynne Shotwell addressed this directly, stating:

"never meant to be weaponized".

Geopolitical risks have also started to affect Starlink’s revenue. In December 2025, Ontario canceled a $68 million rural internet contract with Starlink, citing concerns over U.S. trade policies and Musk’s political affiliations. Similarly, Italy suspended negotiations on a $1.5 billion secure communications deal after public backlash. These incidents highlight how regulatory and political challenges can directly impact SpaceX’s bottom line. On top of these hurdles, competition in the satellite internet market adds another layer of difficulty.

Competition in the Satellite Internet Space

While SpaceX leads the market, competition is heating up on multiple fronts. Amazon’s Project Kuiper launched its first 27 satellites in April 2025, marking the start of a planned 3,200-satellite network. Although Amazon trails by 2–3 years in deployment, its $17 billion investment and integration with AWS could pose a serious challenge to Starlink down the road.

Traditional satellite operators are also regrouping to compete. Eutelsat’s acquisition of OneWeb and Viasat’s merger with Inmarsat aim to create multi-orbit solutions that rival Starlink’s low-Earth orbit (LEO) capabilities. Telesat CEO Dan Goldberg remarked:

"Starlink's emergence has caused significant disruption in the satellite industry - I am seeing the company 'everywhere'".

Government-backed constellations present yet another threat. China’s SpaceSail plans to deploy 15,000 satellites, while the European Union is developing its IRIS² constellation. These initiatives provide nations with alternatives to relying on U.S.-based infrastructure. Craig Moffett, Senior Managing Director at MoffettNathanson, noted:

"I certainly imagine that NATO and Ukraine are at least quietly dancing for joy about the idea of having someone other than Elon Musk in the position of providing capacity".

Operational challenges compound these competitive pressures. Starlink’s satellites have a lifespan of just five years, requiring continuous and costly replacements. Network congestion in high-demand areas has forced the company to introduce congestion fees ranging from $100 to $250, potentially driving cost-conscious customers toward competitors. Additionally, the frequency of collision-avoidance maneuvers - averaging one every five minutes as of late 2024 - highlights the operational strain of managing an expanding satellite fleet. Professor Hugh Lewis from the University of Southampton cautioned:

"I do not think that we can operate the number of spacecraft safely that we have now, let alone the numbers that are coming down the pipeline".

Although SpaceX benefits from lower launch costs, its reliance on the Starship program introduces uncertainty. Delays in Starship’s development could give competitors the opportunity to close the technology gap, especially as Starlink faces capacity constraints in its most lucrative markets. These operational and market challenges could significantly influence future revenues and investor returns, making it essential to follow a checklist for meeting pre-IPO minimums before committing capital.

Valuation Insights and Pre-IPO Opportunities

SpaceX Valuation and Growth Drivers

SpaceX's valuation has been climbing steadily, driven largely by the success of Starlink and the efficiency of the Falcon 9 rocket. Thanks to Falcon 9's reusability, launch costs have dropped by 70%, and refurbishment costs are just 10% of what it takes to build a new rocket. This efficiency has positioned SpaceX to command a staggering 90% share of the global payload mass launched by 2025, solidifying its competitive edge.

On the revenue front, SpaceX's growth potential is undeniable. Projections show revenue increasing from $8.18 billion in 2024 to $22.6 billion by 2027. With Starlink alone carrying a valuation of $400 billion, its revenue multiple of 34× far exceeds that of traditional telecom giants like AT&T, which trades at around 8×. This steep premium reflects investor confidence in SpaceX's ability to maintain its technological edge.

A key driver of future valuation is the Starship program, which has the potential to revolutionize the space industry. SpaceX COO Gwynne Shotwell has expressed high hopes for Starship, stating:

"Ultimately, I think Starship will be the thing that takes us over the top as one of the most valuable companies".

Starship's ability to reduce launch costs to $10 per kilogram and deploy next-generation V3 satellites with 10× the data capacity of current models could significantly enhance SpaceX's financial outlook. Elon Musk has also highlighted Starlink's critical role in funding SpaceX's broader ambitions:

"Starlink is how we are paying for humanity to get to Mars".

However, valuation growth is increasingly tied to operational performance. SpaceX's EBITDA multiples have tightened from 247× in 2021 to 51× in 2024. Analysts predict an IPO could happen as early as 2025 or 2026, with valuations projected between $1 trillion and $1.5 trillion. This timeline underscores the narrowing window for pre-IPO investment opportunities.

How to Invest in SpaceX and Starlink Pre-IPO

For those looking to tap into SpaceX's growth, private equity markets offer a way in. Since Starlink operates as a subsidiary, investing in SpaceX provides direct exposure to Starlink's performance. Shares are primarily traded through secondary transactions among accredited investors, making private equity the main avenue for pre-IPO access. Resources like the SpaceX Stock Investment Guide can help investors navigate private equity, understand valuation trends, and develop tailored strategies for investing in SpaceX and Starlink.

There’s also speculation that SpaceX might approach an IPO through a partial spin-off of Starlink or by creating a "tracking stock" tied to its performance. Musk hinted in December 2025 that IPO plans are "coming soon", signaling that a traditional public offering could also be in the cards.

However, investors should be mindful of the risks. The Starship program's capital demands are significant, and Musk has acknowledged that bankruptcy could become a concern if launch frequencies fall short of targets. Delays in Starship flights could ripple through SpaceX's operations, affecting Starlink's deployment timeline and the company's valuation. Still, with Starlink's subscriber base projected to hit 7 million by September 2025 and generate $11.8 billion in revenue that same year, the potential rewards for pre-IPO investors remain compelling - provided SpaceX can maintain its operational momentum and justify its premium valuation.

Why Starlink Could Be Worth Trillions - Starlink Valuation

Key Takeaways for Investors

SpaceX's push into satellite internet through Starlink presents both exciting opportunities and notable risks. By 2025, the company had launched 90% of the world's total payload mass, achieved 7 million Starlink subscribers, and generated $11.8 billion in revenue. With gross margins expected to climb from 7% in 2024 to 25% by 2026, Starlink is shifting from being heavily capital-intensive to becoming a cash-generating infrastructure asset.

However, these impressive figures come with significant financial and market challenges. For instance, pre-IPO shares might remain locked for 5 to 10 years, and private market pricing lacks the transparency found in public markets. SpaceX's valuation of $400 billion as of mid-2025 represents a revenue multiple of 34× - a stark contrast to traditional telecom companies like AT&T, which trade at around 8×. This lofty premium underscores investor confidence in SpaceX's cutting-edge technology but also signals heightened risk.

Regulatory and operational hurdles also weigh heavily on SpaceX. The company must navigate international spectrum allocations, orbital safety regulations, and the substantial capital needs of its Starship program. Any delays in Starship deployment could disrupt Starlink's growth trajectory and impact the company's overall valuation.

For investors, a cautious approach is advisable. Limiting pre-IPO investments while avoiding fraud risks to 5%–10% of your portfolio through trusted secondary platforms can help manage risk. A long-term perspective - spanning 10 to 15 years - is essential, given the technical and regulatory challenges SpaceX faces. Resources like the SpaceX Stock Investment Guide can provide deeper insights into valuation trends, private equity mechanics, and critical milestones, such as Starship's flight schedule and regulatory approvals in emerging markets.

The potential for high returns is undeniable. Analysts estimate that SpaceX's valuation could soar to between $1 trillion and $1.5 trillion by the time of its IPO, which may occur as early as 2025 or 2026. Ultimately, SpaceX's long-term success will depend on its ability to maintain efficient operations, secure favorable regulatory outcomes, and uphold its technological leadership in the industry.

FAQs

What challenges does Starlink face as it expands globally?

Starlink’s ambition to deliver worldwide broadband access comes with its share of challenges. One major obstacle is the increasing competition from well-funded players like Amazon’s Project Kuiper and China’s state-backed SpaceSail. These rivals are quickly rolling out their own satellite networks, targeting overlapping markets, and intensifying the race for orbital slots and spectrum allocation.

Regulatory and political issues also complicate Starlink’s efforts. In countries such as India and China, restrictions on foreign satellite internet services can hinder its growth. On top of that, Elon Musk’s high-profile political ties have drawn regulatory attention in certain areas, making it harder to secure licenses and comply with local data sovereignty laws.

Another challenge lies in the logistics and costs of maintaining and expanding its massive constellation of over 7,800 satellites. Frequent rocket launches and the push to develop next-generation technologies like the Starship launch system demand substantial financial resources. Balancing these expenses while staying at the forefront of innovation adds to the strain. Even so, Starlink continues to push forward, steadily growing its presence around the globe.

How will Starlink's Direct-to-Cell technology drive its growth opportunities?

Starlink’s Direct-to-Cell technology leverages its extensive network of more than 650 low-Earth orbit (LEO) satellites to deliver uninterrupted 4G coverage in areas where conventional mobile networks fall short. This approach taps into the expanding satellite-to-device market, projected to reach an estimated $66.8 billion in revenue over the next ten years.

By bridging connectivity gaps for countless users in remote and underserved locations, this service not only broadens Starlink’s reach but also solidifies its role as a major contender in the rapidly advancing satellite communications sector.

What are the potential risks and rewards of investing in SpaceX if it goes public?

Investing in SpaceX’s potential IPO presents an exciting opportunity, particularly with the company's valuation projected to soar to $1 trillion, largely fueled by the rapid expansion of Starlink. By 2025, Starlink is anticipated to rake in around $11.8 billion in revenue, with its subscriber base expected to surpass 7 million.

That said, there are challenges to consider. SpaceX is grappling with steep costs tied to Starship development, regulatory hurdles in critical markets like India and China, and growing competition from rivals such as Amazon and OneWeb. Weighing these opportunities against the risks is essential for making well-informed investment choices.

Comments ()