Mars Transfer Windows: What Investors Should Know

How the 2026 Mars transfer window and planned Starship tests could affect timelines, IPO prospects, Starlink revenue, and investor risk.

Mars transfer windows are launch opportunities that occur every 26 months when Earth and Mars align, enabling fuel-efficient space travel. For SpaceX, these windows dictate mission timelines, technological milestones, and investment strategies. The upcoming 2026 window is critical, with plans for five uncrewed Starship missions to test Mars landing systems. Success could accelerate crewed missions by 2030 and solidify SpaceX's valuation ahead of a potential IPO.

Key points:

- Mars Transfer Windows: Align every 26 months, allowing cost-effective travel between Earth and Mars.

- 2026 Missions: SpaceX plans five uncrewed Starship launches to validate Mars landing capabilities.

- Investor Impact: Success could boost SpaceX's valuation, with Starlink revenue providing financial stability.

- Risks: Delays in meeting these windows could push timelines back by two years.

This window is a major test for SpaceX’s Mars ambitions and its financial future.

SpaceX's Starship Plan to Land on Mars in 2026

SpaceX's 2026 Mars Transfer Window Plans

The 2026 transfer window marks a pivotal moment for SpaceX, offering the first chance to demonstrate Starship's ability to land on Mars. During this period, SpaceX plans to launch around five uncrewed Starship missions. These missions aim to validate the spacecraft's landing capabilities while also deploying Optimus humanoid robots to help set up ground infrastructure and locate water ice deposits on the Martian surface. This ambitious plan builds upon lessons learned from earlier missions and is designed to assess both technical and operational risks.

Uncrewed Starship Missions Planned for 2026

Executing these missions involves enormous logistical challenges. Each Mars-bound Starship requires roughly 1,200 tons of propellant, necessitating approximately 12 tanker launches per spacecraft to refuel in Earth's orbit. With up to five missions planned, this means SpaceX could require as many as 60 tanker launches. However, as of early 2025, the company has only tested an internal transfer of 5 metric tons of propellant during a flight - far short of the scale required for a full Mars mission. Elon Musk has stated that there is about a 50% chance that SpaceX will be technically prepared to utilize the 2026 window.

Technical Hurdles SpaceX Must Solve

Orbital refueling is just one of the significant challenges ahead. Another major obstacle is the durability of Starship's reusable metallic-ceramic heat shield tiles. These tiles must endure Mars' thin, CO₂-heavy atmosphere, which is more corrosive than Earth's. As Elon Musk pointed out:

No one has ever developed a truly reusable orbital heat shield.

Landing Starship on Mars presents additional difficulties. At 52 meters tall and weighing over 200 tons, Starship is roughly 200 times heavier than any previous spacecraft to attempt a Martian landing. Scott Hubbard, a former Director of NASA Ames Research Center, highlighted the risks:

Landing vertically looks very slick, but look at the failures to land on the moon with a tall, slender vehicle.

Successfully overcoming these hurdles is essential, as the outcomes of the 2026 missions will directly influence the timeline for sending humans to Mars.

How 2026 Results Affect Crewed Mission Timelines

The success or failure of these uncrewed missions will have a profound impact on SpaceX's broader Mars plans. Elon Musk has stated:

If those landings go safely, then the first crewed flights to Mars will be in 4 years.

On the other hand, mission failures could delay crewed flights by 26 months due to the constraints of orbital mechanics. The results of the 2026 missions will not only shape SpaceX’s Mars timeline but also affect investor confidence. A successful campaign could accelerate SpaceX's vision of Mars colonization, with plans for 20 missions in 2028, 100 in 2030, and 500 by 2033.

What Mars Transfer Windows Mean for Investors

The 2026 Mars transfer window isn’t just a technical milestone for SpaceX - it’s a moment that could reshape the company’s valuation and its ambitious $1.5 trillion IPO target.

How Mission Success Impacts SpaceX Valuation

SpaceX has seen its private market share price soar, jumping from around $76 in 2021 to $185 by 2025. By December 2025, secondary market transactions valued shares at approximately $420, pushing the company’s valuation to an estimated $350 billion. This growth reflects strong investor belief in SpaceX’s dual revenue streams: the steady subscription income from Starlink and the long-term promise of Mars exploration.

The 2026 transfer window is a critical test. Successfully landing five uncrewed Starships on Mars would demonstrate key technologies like orbital refueling and reusable heat shields - both essential for SpaceX’s journey toward a trillion-dollar valuation. However, Elon Musk has tempered expectations, estimating only a 50% chance of meeting the late 2026 deadline. If SpaceX achieves these goals, it would solidify plans for a mid-to-late 2026 IPO, potentially raising over $30 billion - topping the $29 billion record set by Saudi Aramco in 2019.

Starlink plays a pivotal role here, generating roughly 70% of SpaceX’s revenue. With projections of $22 billion to $24 billion in revenue by 2026, its 8 million active customers provide the financial backbone for SpaceX’s high-risk Mars initiatives. This steady income stream positions SpaceX as both an aerospace innovator and a telecommunications leader, creating momentum for pre-IPO strategies.

Pre-IPO Opportunities for Retail Investors

For retail investors, SpaceX’s valuation growth has opened doors to private equity markets. Secondary platforms now offer access to SpaceX shares, allowing early employees to cash out and giving investors a chance to participate in the company’s growth. These transactions help establish market-driven valuations, fueling interest in early-stage investments.

However, private equity investing can be tricky, especially for those unfamiliar with its complexities, such as illiquid assets and high minimum investments. Tools like the SpaceX Stock Investment Guide help investors navigate these challenges by tracking pricing trends, explaining valuation shifts, and outlining strategies for pre-IPO participation.

Beyond direct equity, some investors are taking a broader approach by supporting companies tied to the space economy. This includes firms producing aerospace materials like titanium and carbon fiber or those advancing technologies like orbital refueling. These investments offer exposure to the industry while reducing reliance on SpaceX’s Mars timeline.

Risks of Mission Delays

Delays in meeting Mars transfer windows come with substantial risks. Missing the 2026 window means a 26-month delay before the next opportunity, pushing back crewed missions and lengthening the wait for investor returns. For an already illiquid asset, this could mean a longer holding period and increased opportunity costs.

SpaceX has poured over $10 billion into the Starship program. Yet, technical setbacks - like the disintegration of Starship during its ninth test flight - can create dramatic valuation swings and shake investor confidence. Lori Garver, former NASA Deputy Administrator, put it bluntly:

SpaceX is pushing boundaries, but results are not what we hoped for.

Scaling orbital refueling remains a major challenge. As Donald Rapp from NASA’s Jet Propulsion Laboratory explained:

Starship needs 1,200 tons of propellant, and you've got a tanker that takes 100 tons at a time.

For private equity investors, delays mean extended periods of illiquidity and postponed returns. The stakes for the 2026 window couldn’t be higher - SpaceX’s ability to execute its mission is directly tied to its financial future.

Mars Transfer Windows Beyond 2026

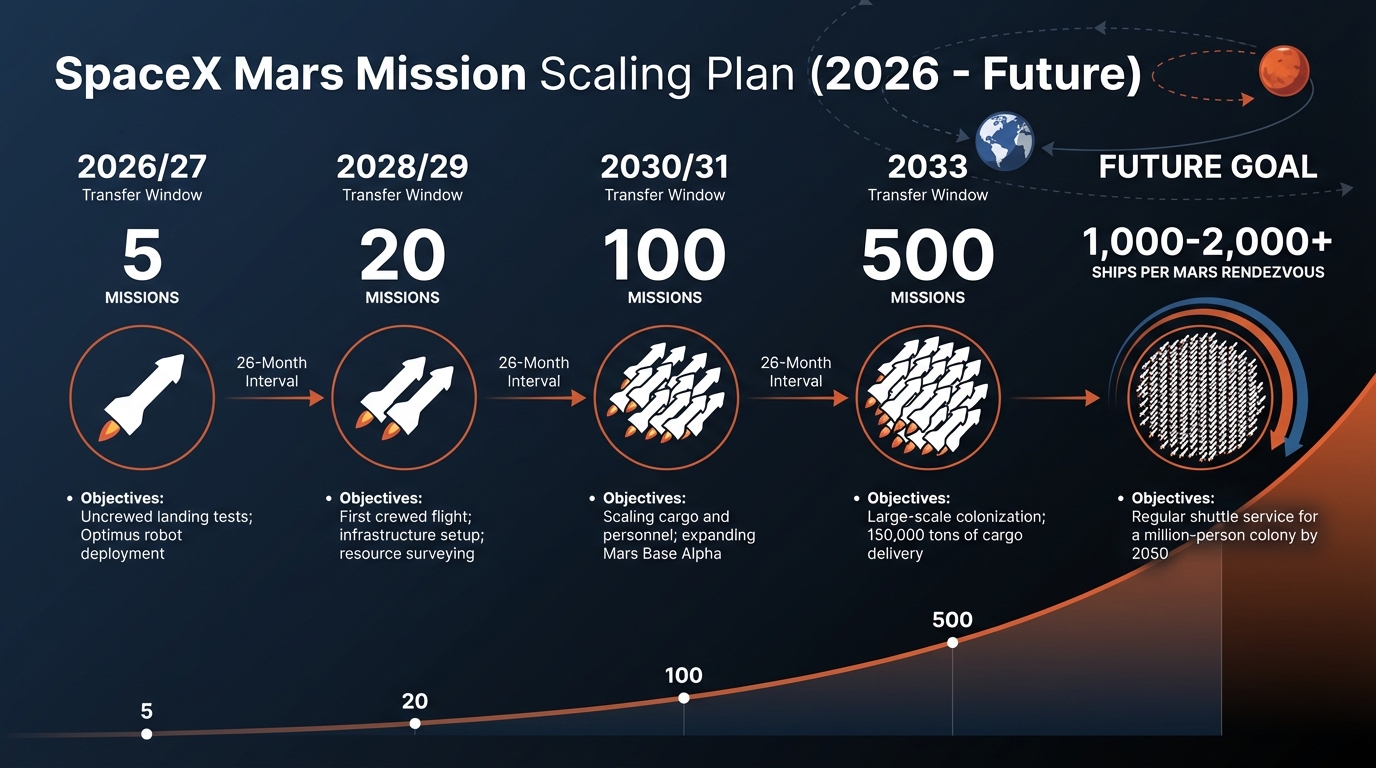

SpaceX Mars Mission Timeline 2026-2033: Scaling from 5 to 500 Missions

The 2026 Mars transfer window is just the beginning. SpaceX envisions a future where Mars missions evolve from initial test flights to large-scale operations capable of transporting up to 150,000 tons of cargo. This ambitious leap builds on earlier uncrewed and crewed mission tests, laying the groundwork for sustained Mars operations on an industrial scale.

SpaceX's Mars Mission Scaling Plans (2028-2033)

SpaceX has laid out an aggressive timeline for scaling its Mars missions, with Elon Musk aiming for "1,000 or 2,000 ships per Mars rendezvous" to establish a consistent shuttle service between Earth and Mars. Following the five uncrewed Starships planned for 2026, SpaceX intends to ramp up to approximately 20 Starships during the 2028/29 transfer window. This phase will include the first crewed mission and the deployment of Optimus robots to begin building essential infrastructure. By 2030/31, the number of missions is expected to jump to 100, and by 2033, SpaceX aims to conduct around 500 missions.

The ultimate goal? Delivering one million people to Mars by 2050 to establish a self-sustaining colony. To make this vision a reality, SpaceX plans to create an orbital staging area where thousands of ships can refuel before launching in unison toward Mars.

However, scaling up to hundreds of missions will require a massive increase in propellant production and refueling capabilities. Meeting this demand means conducting thousands of tanker missions within each 26-month transfer window, a logistical and technical challenge that will push SpaceX's infrastructure and launch cadence to their limits.

Obstacles to Scaling Mars Operations

As SpaceX ramps up its Mars operations, the challenges grow just as quickly. One major hurdle is ensuring safe landings on Mars' uneven terrain. Scott Hubbard, former director of NASA Ames Research Center, cautioned:

Landing vertically looks very slick, but look at the failures to land on the moon with a tall, slender vehicle.

Another challenge lies in generating the resources needed for return trips. For example, producing 600 tons of liquid oxygen for a return flight would require roughly 38,400 square meters of solar panels. Additionally, equipment on Mars would need to process about 33 tons of regolith daily to extract 5 tons of propellant, assuming a 15% water content. Michael Hecht, principal investigator for NASA's MOXIE experiment, highlighted the difficulty:

The solar arrays are going to be more massive, certainly, than the reactors would be.

Operational challenges extend beyond engineering. Communication delays - up to 22 minutes one way - mean missions will rely heavily on automation and advanced AI to handle medical and technical emergencies. To address this, SpaceX plans to deploy a "Martian Starlink" network, enabling high-bandwidth communication between Earth and Mars.

For investors monitoring SpaceX's progress, each technical milestone - whether it's orbital refueling or in-situ resource utilization - represents a critical step forward. These achievements reduce risks and solidify the long-term investment potential. However, the 26-month intervals between transfer windows mean any delays could significantly impact mission timelines and returns.

| Transfer Window | Projected Missions | Primary Objectives |

|---|---|---|

| 2026/27 | 5 | Uncrewed landing tests; Optimus robot deployment |

| 2028/29 | 20 | First crewed flight; infrastructure setup; resource surveying |

| 2030/31 | 100 | Scaling cargo and personnel; expanding Mars Base Alpha |

| 2033 | 500 | Large-scale colonization; 150,000 tons of cargo delivery |

| Future Goal | 1,000–2,000 | Regular shuttle service for a million-person colony |

Conclusion: What Investors Need to Know

Why Transfer Windows Matter for Investment Timing

Mars transfer windows are critical moments for evaluating SpaceX's progress. Every 26 months, the company faces a key deadline - either demonstrating advancements or dealing with a two-year delay. These windows are not just about technical achievements; they also shape market confidence. With SpaceX aiming for an IPO in 2026, the five uncrewed Starship landings planned during this period will play a major role in determining the company's readiness for public markets.

For investors, these checkpoints are more than technical milestones - they're opportunities to gauge SpaceX's preparedness. Success with orbital refueling and the Starship's heat shield performance during the 2026 window will set the stage for crewed missions in 2028. On the flip side, any delays could significantly impact timelines. Starlink’s projected revenue of $12.8 billion in 2025, which accounts for 70% of SpaceX’s estimated total revenue of $18.2 billion, is a financial backbone supporting these ambitious goals.

Next Steps for Potential Investors

As the 2026 IPO approaches, investors should keep a close eye on SpaceX’s flight tests and progress in orbital refueling - both are essential for the Mars mission’s success.

The SpaceX Stock Investment Guide is a helpful resource for understanding pre-IPO opportunities. It provides insights into valuation trends, private equity strategies, and mission milestones that could influence the company’s stock performance.

Potential investors should weigh Starlink's steady cash flow against the high-risk nature of missions tied to the 26-month cycle. The next two years will be pivotal in determining whether SpaceX’s Mars ambitions translate into tangible value for shareholders or face further setbacks.

FAQs

What technical challenges does SpaceX face for its planned Mars missions in 2026?

SpaceX's ambitious plans for Mars missions in 2026 come with a host of tough technical hurdles. Key among them are precise navigation, advanced propulsion, and addressing crew health risks. Mars transfer windows, which open roughly every 26 months, require pinpoint trajectory planning to optimize fuel use and ensure the spacecraft reaches its destination. Even with perfect timing, the journey to Mars takes between 6 and 9 months, during which astronauts face dangers like radiation exposure, muscle and bone deterioration, and other health complications. To cut down travel time, SpaceX is investigating advanced propulsion systems, including nuclear-thermal and electric engines. However, these technologies are still in the experimental phase and untested for human spaceflight.

The Starship system itself must meet extraordinary demands for reliability, payload capacity, and rapid turnaround between launches. SpaceX envisions launching multiple Starship rockets daily during transfer windows to carry the enormous payloads required for establishing a sustainable presence on Mars. Achieving this will require breakthroughs in reusable rocket technology, thermal protection systems, and efficient ground operations. On top of that, life-support systems, radiation shielding, and autonomous navigation need to be robust enough to handle both the journey and extended operations on the Martian surface. These challenges underscore the ambitious and complex nature of SpaceX's goals for the 2026 Mars mission.

What impact could the 2026 Mars missions have on SpaceX's IPO plans?

The results of the 2026 Mars missions are expected to heavily influence SpaceX's plans for going public. A successful mission could bolster investor confidence, making it easier for SpaceX to hit its ambitious target of raising $30 billion and aiming for a valuation in the trillions.

However, if the missions encounter major setbacks or fail to deliver on expectations, it could dampen market enthusiasm. This might delay the IPO or create additional hurdles in the process. Investors are likely to view these missions as a critical measure of SpaceX's technological capabilities and overall financial outlook.

What are the risks for investors if SpaceX misses the 2026 Mars transfer window?

If SpaceX misses the 2026 Mars transfer window, it could spell trouble for investors. Such a miss would mean a two-year delay, throwing off key milestones and pushing revenue projections further down the road. This kind of setback could also ramp up execution risks, especially since critical challenges - like orbital refueling and ensuring test-flight reliability - might linger unresolved for longer.

On top of that, delays could shake investor confidence and slow down SpaceX's valuation growth. Pushing timelines for ambitious goals, like interplanetary travel, further into the future could make it harder to maintain enthusiasm. For investors, this serves as a reminder of the unpredictable and complex nature of space exploration.

Comments ()