How Starlink’s Phone and EchoStar Deal Impacts SpaceX

Explore how SpaceX's Starlink phone plans and the EchoStar deal could reshape global telecom and satellite connectivity.

Introduction

Elon Musk’s ventures have always been about reshaping industries, from Tesla revolutionizing sustainable transportation to SpaceX redefining space exploration. With recent advancements in SpaceX’s Starlink satellite network and the EchoStar spectrum acquisition, Musk is poised to disrupt yet another industry: telecommunications. The convergence of satellite technology, mobile phones, and AI promises to deliver not only global connectivity but a transformative ecosystem of services.

This article unpacks SpaceX’s plans, including the Starlink mobile phone concept, the implications of the EchoStar deal, and how these developments could impact investors and reshape the global telecom landscape. If you’re an aspiring or retail investor eyeing pre-IPO opportunities or simply curious about SpaceX’s trajectory, this analysis will help you make sense of the seismic shifts ahead.

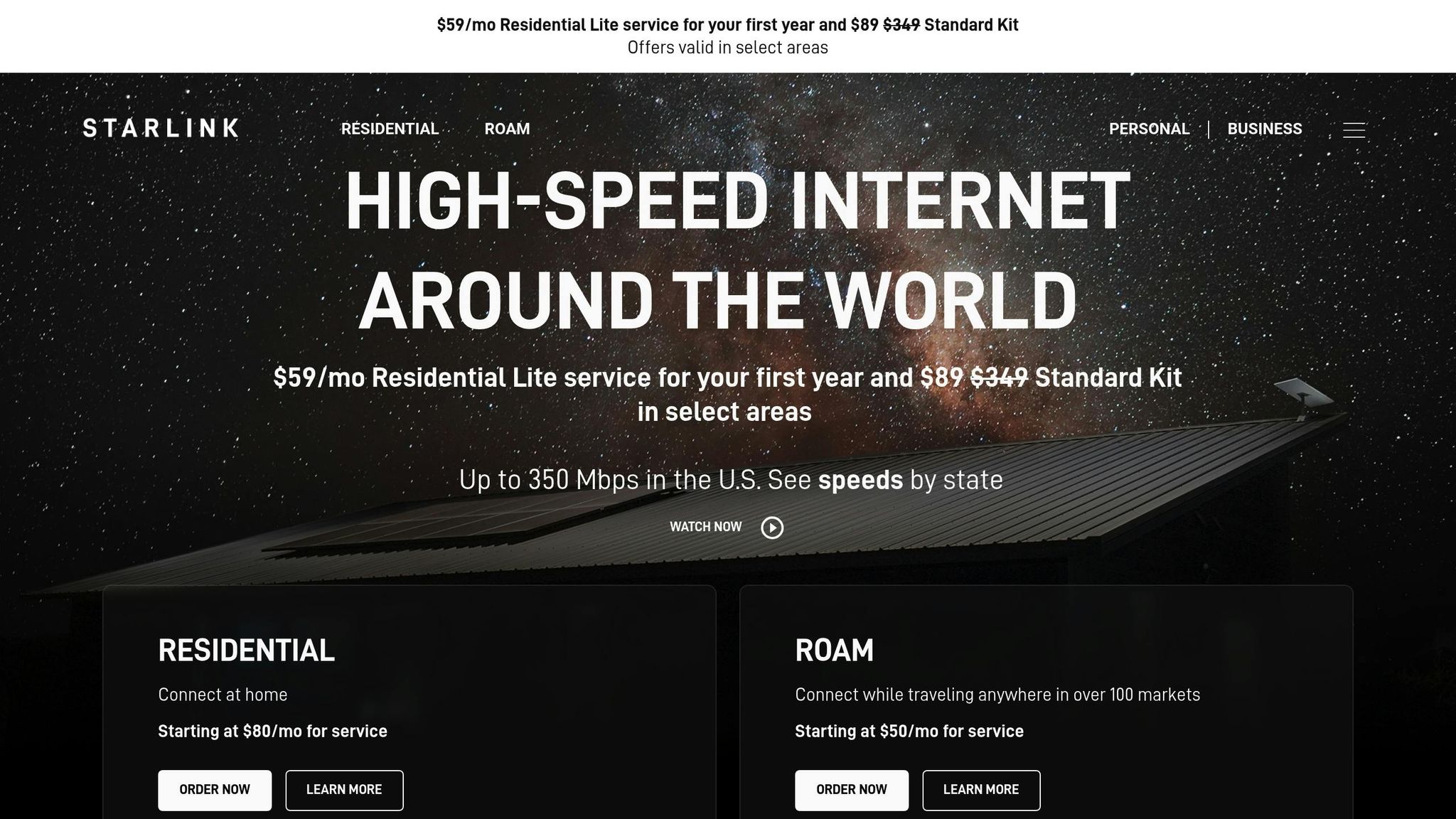

The Starlink Phone: A New Era in Mobile Connectivity

A Unified Device for Global Communication

Elon Musk recently hinted at his vision for a Starlink phone during the All-In Summit. The device would combine a suite of services, including Starlink connectivity, AI (via XAI and Grok), X Payments, and even Tesla’s autonomous technologies like Robotaxi. This ambitious plan centers on a unified, global device offering seamless internet access, bypassing traditional carrier networks.

Unlike existing mobile phones limited by terrestrial towers and regional carriers, the Starlink phone would leverage SpaceX’s low Earth orbit (LEO) satellite constellation to deliver high-bandwidth connectivity worldwide. Musk projects a two-year timeline for the development of phones capable of integrating with the newly acquired spectrum. This hints at a broader strategy not just to create a product but to dominate the mobile market by redefining its infrastructure.

The EchoStar Deal: Unlocking Spectrum and Opportunities

What Is the EchoStar Deal?

SpaceX’s acquisition of EchoStar’s S-band spectrum for $17 billion is a strategic masterstroke. EchoStar, an aging satellite operator primarily focused on geostationary satellites, had been losing ground to LEO competitors like Starlink. By purchasing EchoStar’s underutilized spectrum, SpaceX gains critical bandwidth needed for direct-to-phone communications.

Why Is This Spectrum Important?

The S-band spectrum offers several advantages:

- Improved Penetration: The S-band frequency penetrates walls, tree cover, and other barriers more effectively than higher-frequency bands, making it ideal for mobile connectivity in both urban and rural areas.

- High Global Utilization: S-band complements existing Starlink capabilities, ensuring better service in areas underserved by traditional telecom networks.

- Regulatory Leverage: Governments are likely to favor SpaceX’s ability to maximize spectrum utilization, as unused spectrum can often revert to government control. By leveraging EchoStar’s spectrum, SpaceX avoids future regulatory battles and solidifies its market position.

This deal also signals a shift in strategy for smaller satellite operators. EchoStar, unable to compete with SpaceX’s scale and efficiency, opted to sell its spectrum for a mix of cash and SpaceX stock - a move that may become a model for other struggling telecom companies.

Scaling the Starlink Network: Moving Toward Gen-3 Satellites

From Dishes to Direct-to-Mobile

Currently, Starlink provides high-speed internet via ground-based dishes, with over 7 million customers globally. Manufacturing capacity for these dishes remains a bottleneck, but SpaceX is addressing this by scaling production facilities and transitioning to a new generation of satellites.

SpaceX’s Gen-3 satellites, set to deploy via the Starship rocket, will significantly boost bandwidth and coverage. These satellites are:

- Larger and More Powerful: Each satellite will weigh approximately two tons, offering up to 20 times the bandwidth of current Gen-2 minis.

- Lower Altitude: Positioned at 300 km rather than 500 km, these satellites will reduce latency and improve data speeds.

- Efficient Launches: Starship’s capacity to carry 60 Gen-3 satellites per launch will drastically reduce deployment costs.

This progression ensures that by the time Starlink phones are ready, the satellite infrastructure will be capable of supporting widespread, high-quality mobile connectivity.

The Bigger Picture: How Starlink Disrupts Telecom and Beyond

Implications for Global Telecom Players

The telecommunications industry is understandably wary. Traditional carriers like Verizon and AT&T depend on terrestrial towers and regional spectrum licenses, which may become obsolete with the rise of satellite-based mobile networks. However, partnerships with SpaceX could offer a lifeline. By sharing spectrum and infrastructure, carriers can reduce costs and expand their service areas, particularly in remote regions.

AI Integration and Beyond

The Starlink phone isn’t just about connectivity. By integrating XAI’s artificial intelligence models into the device, SpaceX aims to create a platform for:

- AI-Powered Apps: On-device AI inference for personalized services and high-speed computations.

- X Payments: A unified payment system that could potentially rival global financial networks.

- Autonomous Functionality: Enhanced support for Tesla’s autonomous vehicles and robots, making the Starlink ecosystem indispensable.

What This Means for Investors

Valuation and Growth Trajectory

SpaceX’s current valuation stands at approximately $400 billion, with Starlink already generating significant revenue from its growing customer base. Analysts project that Starlink could evolve into a $6 trillion enterprise within the next few years, driven by:

- Increased adoption of satellite internet services.

- Expansion into mobile telecom markets.

- Strategic partnerships and spectrum acquisitions.

If and when SpaceX spins off Starlink into a standalone IPO, it could unlock immense value for investors. Early adopters of Starlink stock could position themselves for exponential gains, similar to those seen in Tesla’s meteoric rise.

Potential IPO Timeline

Based on current growth rates and infrastructure expansion, a Starlink IPO could occur as early as late 2026. By then, SpaceX expects to have millions of additional customers, multiple revenue streams from mobile and AI services, and a mature satellite network supporting these initiatives.

Key Takeaways

- Starlink Mobile Revolution: A Starlink phone is in development, aiming to unify global connectivity, AI, and autonomous services.

- Spectral Leverage: The $17 billion EchoStar deal grants SpaceX critical S-band spectrum for mobile connectivity, improving coverage and service quality.

- Next-Gen Satellites: Gen-3 satellites launching via Starship will dramatically boost Starlink’s bandwidth and capabilities by 2024-2025.

- Investor Opportunity: With Starlink’s valuation poised to skyrocket, a potential IPO in 2026 could provide massive returns for early investors.

- Disruption Across Industries: From telecom to AI and robotics, Starlink stands to reshape multiple sectors, including global communications, transportation, and finance.

- Partnerships or Competition?: Traditional telecom carriers face a choice: partner with SpaceX or risk obsolescence as satellite-based connectivity dominates.

- AI and Payments Integration: The Starlink phone will incorporate XAI for on-device intelligence and X Payments for seamless global transactions.

Conclusion

SpaceX and Starlink are not just disrupting telecommunications; they are laying the groundwork for a new era of planetary-scale connectivity. For investors, this represents an unparalleled opportunity to capitalize on a venture that could redefine multiple industries. With Starlink’s ability to integrate AI, enable global payments, and support autonomous systems, it’s clear that SpaceX is crafting more than just a telecom network - it’s building the infrastructure for a future we’re only beginning to imagine.

As the Starlink ecosystem evolves, retail investors, entrepreneurs, and visionaries alike should pay close attention. The convergence of satellite technology, AI, and connectivity doesn’t just promise growth - it guarantees transformation on a global scale.

Source: "Elon's $17B Move: Starlink Phone to 3 BILLION Users by 2030 – Bigger Than iPhone & Facebook!" - Next Big Future, YouTube, Sep 11, 2025 - https://www.youtube.com/watch?v=ccqmwKwFHTA

Use: Embedded for reference. Brief quotes used for commentary/review.

Comments ()