Global Data Privacy Trends in Private Equity

Expanding US and EU privacy rules — including California’s 2026 CCPA updates, DORA and GDPR shifts — force private equity firms to tighten due diligence, governance and AI/cyber controls.

Private equity firms are navigating a tougher regulatory environment as data privacy laws expand globally. Here's the bottom line:

- 19 U.S. states now enforce consumer privacy laws, with stricter rules in California starting January 2026.

- The EU's new regulations simplify some GDPR requirements but add cybersecurity and AI compliance challenges.

- High penalties are in play: Texas settled a $1 billion privacy case, and California introduced executive-level accountability for privacy failures.

- M&A deals face more scrutiny due to successor liability, requiring firms to address privacy risks tied to acquired companies.

Key actions for firms include improving due diligence, aligning with U.S. and EU rules, and preparing for stricter enforcement timelines.

Quick Overview of Key Regulations:

- California CCPA Updates: Executive certifications, AI transparency, and cybersecurity audits.

- EU GDPR Adjustments: New definitions for personal data and streamlined breach reporting.

- DORA and NIS2: ICT risk management and incident reporting for EU-based firms.

Private equity firms that prioritize compliance can reduce risks, avoid penalties, and build trust with investors.

US Data Privacy Laws and Private Equity

CCPA Changes Effective January 1, 2026

California’s updated privacy laws are raising the bar for how businesses handle high-risk data processing. Companies involved in selling or sharing personal data, processing sensitive information, or relying on Automated Decision-Making Technology (ADMT) for critical decisions - like lending, hiring, or healthcare - now need to conduct and document risk assessments. For portfolio companies, these assessments must be completed before starting high-risk processing or, for existing activities, by December 31, 2027.

These assessments must be certified by an executive, who also bears responsibility for cybersecurity audits:

"California is making executives have skin in the game... This elevates privacy to a governance mandate with personal legal risks for the executive".

The law applies to businesses with over $26.62 million in annual revenue that process data for at least 250,000 consumers or handle 50,000 sensitive records. These companies are required to perform cybersecurity audits, with deadlines based on revenue size. Firms earning over $100 million must submit audits by April 1, 2028; those earning between $50 million and $100 million by April 1, 2029; and smaller businesses by April 1, 2030. Both companies and their auditors must keep all related documentation for five years.

Starting January 1, 2027, new ADMT rules will require businesses to provide pre-use notices and allow consumers a 15-business-day window to opt out. Portfolio companies using AI for decisions like hiring, credit approvals, or insurance underwriting will face tougher compliance demands. Additionally, consumers can request access to personal data collected as far back as January 1, 2022, if the information is still retained. Notably, California has expanded its definition of sensitive personal information to include neural data - information derived from brain or nervous system activity.

These heightened regulations are already influencing enforcement trends.

Enforcement Actions and Compliance Methods

The stricter requirements have led to notable enforcement actions. In December 2025, CalPrivacy imposed fines on several companies for non-compliance: Tractor Supply Company was fined $1.35 million, American Honda Motor Co. $632,500, and Todd Snyder, Inc. $345,178. Smaller entities aren’t exempt either - a Nevada-based marketing firm, ROR Partners LLC, faced a $56,600 penalty for failing to register as a data broker.

"The rules of the road are clear, and we expect data brokers will register as required. We will continue using all available tools to investigate potential violations and bring enforcement actions where appropriate".

Penalties start at $2,500 per violation and can climb to $7,500 for intentional breaches or those involving consumers under 16 years old.

For private equity firms, these developments mean revisiting M&A due diligence processes to ensure portfolio companies align with revenue and data processing criteria. Companies relying on AI for major decisions need to comply with the January 1, 2027, deadline by demonstrating transparency in how their technology operates.

EU Privacy and Cybersecurity Rules for Private Equity

Major EU Regulatory Updates

The European Union is moving toward a more unified approach to digital regulations. In November 2025, the European Commission introduced the Digital Omnibus proposal aimed at simplifying the EU rulebook, including updates to the GDPR, NIS2, and the Cyber Resilience Act (CRA).

One of the key changes in this proposal is a redefinition of "personal data." Under the new rules, information will only be considered personal data if a specific recipient can reasonably identify the individual. This adjustment could make data sharing during due diligence easier, as portfolio company data might no longer trigger the full range of GDPR obligations.

"The proposed targeted amendments to the GDPR would mark a significant shift in the EU approach to data protection, notably by explicitly stating that the notion of 'personal data' is relative." - Anne-Gabrielle Haie, Partner, Steptoe

Other updates include extending the notification deadline for data breaches from 72 to 96 hours and raising the reporting threshold from a "likely risk" to a "likely high risk" to individuals' rights and freedoms. Additionally, ENISA is working on a centralized portal for incident reporting, allowing firms to meet their obligations under GDPR, NIS2, DORA, and the CER Directive through a single entry point.

The Cyber Resilience Act introduces its requirements gradually, starting with vulnerability and incident-reporting rules in September 2026, and full product-security compliance by December 2027. By late 2025, about half of EU Member States had implemented the NIS2 Directive, leaving portfolio companies to navigate varying national rules.

Meanwhile, the Alternative Investment Fund Managers Directive (AIFMD II) is set to take effect in 2026. This directive brings stricter oversight on delegation and outsourcing to non-EU service providers, along with new disclosures on costs and liquidity. To stay ahead, firms should revisit their oversight frameworks to close any compliance gaps.

These regulatory updates are reshaping how private equity firms manage data and compliance strategies.

Pseudonymization Rules and Portfolio Protection

As the EU refines its data regulations, recent court rulings are also influencing how private equity firms handle portfolio data. A notable decision in the EDPS v. SRB case has provided clarity on pseudonymized data. The European Court of Justice ruled that pseudonymized data might not be considered personal data for a recipient if they lack the means to reasonably identify individuals - even if the original controller can.

"Pseudonymized data may remain personal data for the original controller, but not necessarily for the recipient, depending on whether the recipient can identify the individuals." - EU Court of Justice (EDPS v. SRB judgment)

This ruling has practical implications for portfolio companies sharing operational data during due diligence or oversight. If the receiving firm cannot identify individuals from the data, it may no longer fall under GDPR's strict requirements. The European Commission is expected to issue specific criteria to help determine when pseudonymized data is no longer considered personal, providing more legal clarity.

Private equity firms should revisit their data mapping strategies to assess what now qualifies as personal data under this updated definition. Portfolio companies can also use ISO 27001 certifications to meet overlapping cybersecurity requirements under both the GDPR and the CRA, helping to streamline compliance efforts.

While obligations for high-risk AI systems under the EU AI Act have been delayed from August 2026 to December 2, 2027, firms must still adhere to the original August timeline until formal amendments are finalized. Notably, the updated rules allow "legitimate interests" as a legal basis for processing personal data to develop and operate AI models, provided that appropriate technical and organizational safeguards are in place.

Managing Global Data Privacy Risks in Private Equity

SEC Cybersecurity Disclosure Requirements

Publicly traded private equity firms are required to disclose any material cybersecurity incidents on Form 8-K within four business days, as well as provide annual cybersecurity governance details in Form 10-K filings. The SEC determines materiality based on what a "reasonable investor" might consider impactful to their decisions. In simpler terms, if a cybersecurity incident could influence investment choices, it must be made public.

"Whether a company loses a factory in a fire - or millions of files in a cybersecurity incident - it may be material to investment decisions." - Gary Gensler, Chair, SEC

Annual filings must also specify which board committee is responsible for overseeing cyber risks and outline how management assesses and handles these threats. However, the U.S. Attorney General has the authority to delay disclosure if releasing the information could jeopardize national security or public safety.

For firms operating in the European Union, the Digital Operational Resilience Act (DORA), effective January 2025, introduces additional obligations. DORA mandates financial entities to establish ICT risk management frameworks and conduct digital resilience testing. Private equity managers should coordinate their SEC disclosures with DORA's third-party oversight requirements to ensure a comprehensive approach to risk management across jurisdictions. These U.S. initiatives align with evolving global standards, reinforcing the need for a unified strategy to address data privacy risks internationally.

Meeting GDPR and CCPA Standards

While U.S. firms focus on meeting SEC requirements, they must also contend with international data privacy regulations like GDPR and the updated CCPA. Regulatory bodies are increasingly shifting their focus from creating new laws to strictly enforcing existing ones, with a particular emphasis on identifying operational shortcomings and compliance failures.

Private equity firms must also navigate successor liability during acquisitions. Regulators expect thorough due diligence to uncover compliance risks tied to legacy issues before deals are finalized. Failing to address these risks can result in legal penalties, lawsuits, loss of investor trust, and disruptions to operations.

"A PE firm can gain a competitive advantage by undertaking a compliance health check and transformation program not only within the organization but also across its investment portfolio." - Julia Gebhardt, Katharina Hefter, Astrid Latzel, Florian Meier, and Claudia Hobl-Felbermayr, BCG

California's upcoming 2026 rules introduce another layer of complexity: an executive team member must personally certify the accuracy of the company’s privacy risk assessments. Additionally, regulators are broadening their focus to areas often overlooked, such as HR data, biometric information, and precise geolocation data. To stay ahead, firms should establish a compliance operating model that sets clear standards for governance, risk management, and data architecture across their entire portfolio.

How private equity firms can maximize the value of their portfolio companies by managing technolo...

Cross-Border Compliance Methods for Private Equity

CCPA vs GDPR Compliance Requirements for Private Equity Firms

Integrated Compliance Methods

Managing cross-border investments demands that private equity firms establish unified compliance frameworks. At the heart of this process lies data mapping and inventory, which help identify privacy risks before regulators step in.

For firms relying on cloud services, conducting thorough vendor due diligence is a must. Providers need to align with DORA standards, incorporating features like encryption, multi-factor authentication (MFA), and API logging. Gone are the days of manual spreadsheets - automated privacy systems now take center stage. These modern platforms support "perpetual KYC" (Know Your Customer) processes and dynamic risk reviews, embedding compliance into the earliest phases of investor engagement. This not only accelerates onboarding but also ensures transparency. Some firms are even adopting geographic gatekeeping to pre-screen investors, ensuring they meet local regulatory standards before the onboarding process begins. These integrated systems build upon earlier global compliance strategies, making cross-border oversight more efficient.

"The next wave of global regulation isn't just about checking the boxes, it's about unlocking scale, workflow clarity and investor trust." – Bite Investments

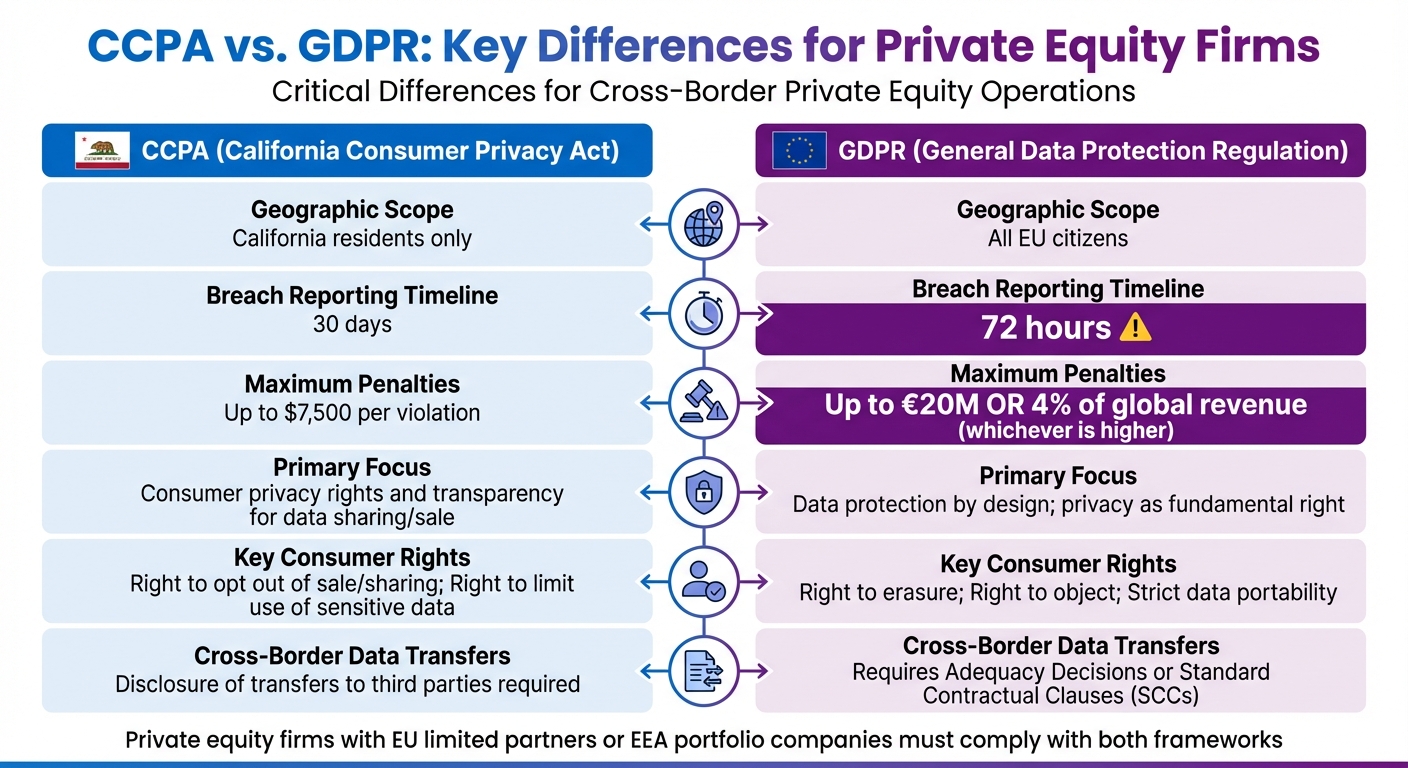

CCPA vs. GDPR: A Comparison for Private Equity

Understanding the differences between the CCPA (California Consumer Privacy Act) and GDPR (General Data Protection Regulation) is crucial for private equity firms navigating cross-border compliance. While both frameworks aim to protect personal data, they differ in scope, timelines, penalties, and the rights they grant. A side-by-side comparison highlights how these differences impact compliance strategies:

| Requirement | CCPA | GDPR |

|---|---|---|

| Scope | California residents | EU citizens |

| Reporting Timelines | 30 days | 72 hours |

| Enforcement Penalties | Up to $7,500 per violation | Up to €20 million or 4% of global revenue |

| Primary Focus | Consumer privacy rights and transparency regarding data sharing or sale | Data protection by design and default; privacy as a fundamental right |

| Key Rights | Right to opt out of sale/sharing, right to limit use of sensitive information | Right to erasure, right to object, and strict data portability |

| Cross-Border Transfers | Disclosure of transfers to third parties and service providers | Requires Adequacy Decisions or Standard Contractual Clauses (SCCs) |

For firms with limited partners in the EU or portfolio companies operating in the European Economic Area, GDPR's 72-hour breach notification window demands rapid incident response protocols. In contrast, the CCPA allows a more extended 30-day timeline. Additionally, GDPR's penalty structure - up to €20 million or 4% of global revenue - poses a far greater financial risk for larger firms, making compliance an essential priority.

Conclusion

Main Takeaways

The regulatory landscape has undergone significant changes in 2026. With 19 U.S. states enforcing comprehensive consumer privacy laws and the EU tightening its grip through measures like DORA and GDPR, private equity firms are now facing heightened scrutiny and enforcement measures.

The financial risks are undeniable. Cases like Texas's settlement exceeding $1 billion and California's $1.55 million settlement highlight the growing consequences. These include personal liability for executives and successor liability for compliance failures at acquired companies.

But there’s also a silver lining. As Boston Consulting Group points out:

"A PE firm can gain a competitive advantage by undertaking a compliance health check and transformation program not only within the organization but also across its investment portfolio and individual portfolio companies."

By embedding compliance into M&A due diligence, setting portfolio-wide standards, and operationalizing opt-out mechanisms, firms can build trust with investors and speed up capital deployment.

Future Outlook

These enforcement trends underline the urgency for firms to act, especially with more regulatory updates on the horizon. The compliance timeline stretches well past 2026. For instance, in January 2027, California's automated decision-making regulations will take effect, requiring notice and opt-out options for AI-driven decisions in areas like housing and employment. By April 2028, the CCPA will mandate detailed annual cybersecurity audits.

Meanwhile, regulatory convergence is picking up speed. State attorneys general are increasingly collaborating, leading to more coordinated enforcement actions. Firms that embrace compliance as a strategic tool - rather than a mere formality - will stand out to limited partners and strengthen their portfolios for long-term success. The key challenge lies in swiftly building compliance infrastructure across entire portfolios before the next wave of regulations hits.

FAQs

What are the main differences between the CCPA and GDPR for private equity firms?

The CCPA (California Consumer Privacy Act), set to take effect on January 1, 2026, is a state law aimed at safeguarding the privacy of California residents. It requires businesses operating in California to be transparent about how they collect, use, and share consumer data. This law is designed to give individuals more control over their personal information.

The GDPR (General Data Protection Regulation), on the other hand, is a far-reaching regulation from the European Union. It applies to any organization - no matter where it's located - that processes the personal data of EU residents. The GDPR enforces stricter rules, such as obtaining explicit consent, securing data, and granting individuals extensive rights over their personal information.

For private equity firms, the main difference between these two lies in their scope. The CCPA is limited to California, while the GDPR applies globally to any entity handling EU residents' data. Despite this distinction, both regulations underscore the increasing need for strong data privacy measures in the private equity industry.

What role do successor liability and due diligence play in data privacy compliance during M&A transactions?

When it comes to mergers and acquisitions (M&A), addressing data privacy compliance is a must. During the due diligence process, buyers take a close look at the target company's data privacy policies, cybersecurity defenses, and adherence to relevant regulations. This step is crucial for spotting potential red flags, like unresolved privacy violations or security weaknesses. Ignoring these risks could lead to legal troubles, financial losses, or even damage to the company’s reputation after the deal closes.

Successor liability adds another layer of complexity. Essentially, this means the acquiring company could inherit the target’s existing data privacy issues if they’re not resolved before the deal is finalized. To avoid this, private equity investors and buyers need to dig deep into the target’s compliance history, regulatory responsibilities, and data security measures. With stricter global data privacy laws in place, skipping these evaluations isn’t just risky - it could lead to hefty fines and operational headaches. That’s why a thorough review of privacy practices is non-negotiable in today’s M&A landscape.

How can private equity firms comply with evolving data privacy regulations in the EU and U.S.?

To keep up with evolving data privacy laws, private equity firms need to adopt strategies that address both EU and U.S. regulatory requirements. In the EU, firms should focus on aligning with frameworks like the EU-U.S. Data Privacy Framework. This includes strengthening data governance practices, conducting regular compliance audits, and maintaining transparency in how data is handled. Staying updated on new regulations and enforcement trends is equally important to ensure policies remain effective.

In the U.S., the regulatory environment is more fragmented, with state-level privacy laws and growing enforcement efforts creating unique challenges. Firms should prioritize comprehensive risk assessments, bolster data security protocols, and implement ongoing compliance programs. Looking ahead, preparing for future rules - like those pushing for executive accountability by 2026 - is essential. Collaborating with legal and cybersecurity experts can help firms develop customized compliance plans, minimizing the risk of fines or damage to their reputation.

Comments ()