Checklist for Assessing C-Suite Leadership Pre-IPO

Assess CEO/CFO public-company experience, board independence, SOX-ready controls, retention plans and investor relations to gauge pre-IPO leadership readiness.

When a company prepares to go public, the leadership team plays a critical role in ensuring a smooth transition. Investors and stakeholders closely scrutinize the CEO, CFO, and other executives to assess their ability to handle the demands of public markets. Here’s a quick breakdown of what to evaluate:

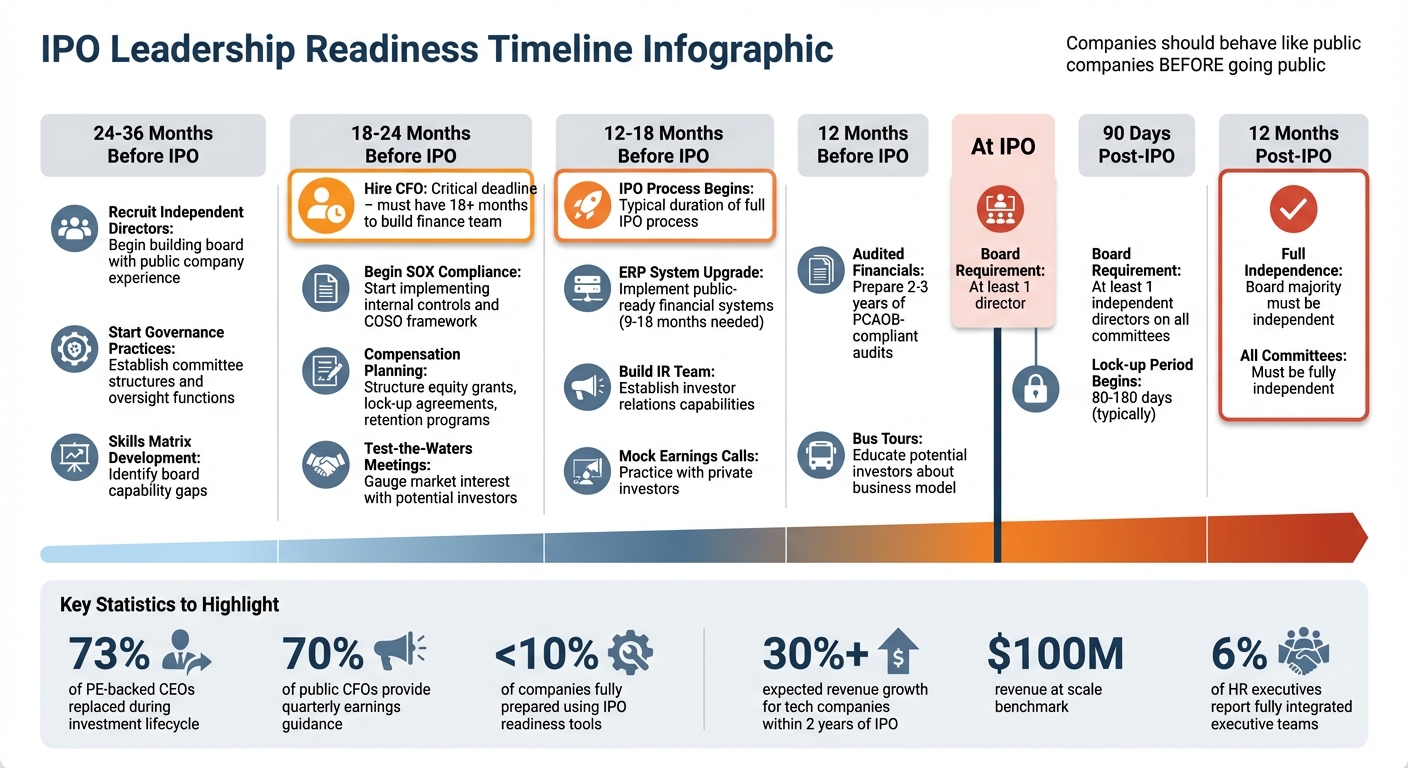

- Leadership Experience: Do the CEO and CFO have prior public company or IPO experience? A CFO should be hired at least 18 months before the IPO to build a capable finance team.

- Industry Knowledge: The team must show a track record of accurate forecasting, timely reporting, and driving growth.

- Team Dynamics: Collaboration and unity within the C-suite are essential. Practices like mock earnings calls and structured decision-making approaches can help prepare for public scrutiny.

- Retention Strategies: Equity compensation, lock-up agreements, and succession planning help maintain leadership stability.

- Board Independence: Public companies must comply with board independence requirements. Recruiting knowledgeable, independent directors early is key.

- Financial Controls: Internal systems must meet regulatory standards, including Sarbanes-Oxley compliance, to handle public reporting demands.

- Investor Relations: A strong narrative, supported by clear KPIs and an engaged investor relations team, is vital for building market trust.

Effective preparation reduces risks, strengthens investor confidence, and sets the stage for long-term success in public markets.

IPO Preparation Timeline: Key Leadership Milestones and Requirements

Executive Leadership Team Composition and Experience

Prior IPO or Public Company Experience

When preparing for an IPO, it's crucial to assess whether the CEO and CFO have prior experience in public markets. These two leaders serve as the company's primary representatives to investors and analysts during the IPO process. A CFO unfamiliar with SEC reporting or quarterly earnings calls can pose a major risk, as public companies are required to report earnings within tight deadlines - just weeks after the close of each quarter.

Building a team ready for the demands of public markets goes beyond just the CEO and CFO. The finance department must include experienced professionals in key roles like controller, treasurer, audit, and tax. These individuals ensure the company can meet the rigorous requirements of public reporting. Recruiters often focus on candidates with expertise in regulatory compliance, scaling operations, and proven success in public companies. Early preparation is critical - this includes implementing systems and processes to handle the demands of public reporting well before the IPO.

"The role of the CFO assumes out-sized proportions in the context of an IPO." – Jeff Jordan, General Partner, Andreessen Horowitz

To ensure a smooth transition, hire your CFO at least 18 months before the IPO. This allows them enough time to build the necessary finance team and systems. A CFO leaving shortly after an IPO can severely damage market confidence and credibility [2, 11].

Industry Expertise and Performance History

Leadership teams must demonstrate the ability to forecast business performance accurately and close financial books on time. Earnings restatements can erode investor trust and significantly impact market value. Beyond public company experience, a history of driving growth within the industry is equally important. For instance, during its growth phase, eBay bolstered its leadership by adding independent directors with extensive public company experience, such as Scott Cook (founder of Intuit) and Howard Schultz (founder of Starbucks). This complemented the internal leadership of CEO Meg Whitman and founder Pierre Omidyar.

Effective leadership teams also focus on internal systems and financial processes well in advance of going public. This preparation minimizes inefficiencies and reduces the likelihood of negative surprises [2, 12]. A strong track record of managing complex operations signals readiness for the increased scrutiny and transparency required in public markets. Leaders also review profit and loss statements to identify and eliminate unprofitable revenue streams or unsustainable pricing models before filing for an IPO. Consider Amazon as an example - its value has multiplied approximately 491 times since its IPO, largely due to strong founder leadership paired with deep industry knowledge.

Team Collaboration and Decision-Making Approach

A successful C-suite operates with an "enterprise-first" mindset, ensuring executives prioritize the company’s overall success rather than focusing solely on their individual departments. Despite its importance, only 6% of top HR executives report having fully integrated executive teams.

One striking example comes from Lilach Asher-Topilsky, who became CEO of IDB, one of Israel's largest banks, in 2014. Faced with underperformance, she replaced around 50% of the senior team and rebranded the new group as "the Fist" to emphasize unity against external pressures from the board, unions, and competitors. This collaborative approach led to a doubling of the bank's return on equity and tripling of net profits during her tenure.

"You can't get in the lines between the fingers. Not the board of directors, union, competitors - not anyone." – Lilach Asher-Topilsky, former CEO, IDB

Leadership teams can also benefit from practices like mock earnings calls with private investors to prepare for the intense scrutiny of public markets [2, 12]. At DBS Group, CEO Piyush Gupta uses the "MOJO" system in senior leadership meetings. A "Meeting Owner" ensures discussions stay on track, while a "Joyful Observer" evaluates meeting productivity in real time. This structured approach helps maintain alignment during critical moments like IPO roadshows.

Establishing a consistent operating rhythm is another hallmark of strong teams. Weekly informal check-ins, monthly formal meetings, and annual off-sites can help minimize surprises and keep everyone aligned on execution. Former Caterpillar CEO Jim Owens took this a step further by implementing annual stress tests. Each division was required to outline strategies for staying profitable during severe downturns. When the 2008 financial crisis hit, Caterpillar was able to enact these pre-approved plans, maintaining stability even as customer orders dropped by more than half.

Next, we’ll explore how retention strategies support long-term leadership stability.

IPO Readiness Roadmap | Ep 6: Executive Search & CFO Recruitment

Leadership Stability and Retention Mechanisms

After exploring team composition and expertise, it's essential to focus on how leadership stability is maintained through effective retention strategies.

Executive Turnover History and Continuity

Leadership turnover can significantly impact a company's stability, especially during critical transitions like an IPO. Data shows that 73% of CEOs in private equity-backed companies are replaced during the investment lifecycle, a stark contrast to the nearly 10-year average tenure of S&P 500 CEOs. This high turnover rate highlights the potential risks tied to shallow leadership depth, particularly in the period immediately following an IPO.

Founders often excel in product innovation and driving company growth. However, they may lack the regulatory expertise and stakeholder management skills required to navigate the complexities of public markets.

"If key executives start leaving post-IPO, investor confidence will crumble." – Jake Parish, Executive Search Expert

To mitigate these risks, companies should start planning for IPO-related compensation and leadership transitions at least 18 to 24 months in advance. This preparation ensures that leadership challenges are addressed early, reducing instability during the transition to public markets.

Equity Compensation and Lock-Up Agreements

Lock-up agreements are a critical tool for maintaining market stability after an IPO. These agreements typically last between 80 and 180 days and prevent company insiders from selling their shares immediately, which could otherwise lead to significant selling pressure.

"A lock-up agreement prevents insiders of a company from selling their shares for a specified period of time (usually around 80 – 180 days) after going public." – J.P. Morgan Workplace Solutions

Another effective retention strategy is providing IPO grants with multi-year vesting schedules. These grants help retain key leaders during the transition period. Boards should actively monitor unvested equity for each executive to identify potential "flight-risk" periods. A balanced equity distribution across leadership reduces the risk of uneven rewards, often referred to as "barbell" risk.

| Retention Mechanism | Purpose | Typical Terms |

|---|---|---|

| Lock-up Agreement | Prevents immediate stock sales; stabilizes market | 80–180 days post-IPO |

| Founders/IPO Grant | Retains key leaders during the transition | Granted at or near IPO; multi-year vesting |

| Evergreen Provision | Ensures equity availability for future grants | Automatic annual percentage increase |

| Double-Trigger Vesting | Aligns executive protection with investor interests | Requires both change in control and termination |

The trend is shifting from single-trigger to double-trigger vesting, addressing concerns that executives might cash out too quickly during a change in control.

Employment Contracts and Retention Programs

A thorough review of employment agreements, severance plans, and change-in-control protections should be conducted well before the IPO. Benchmarking these agreements against industry standards ensures they are competitive and supportive of leadership stability.

"Ideally, a company should start implementing a well-reasoned compensation process... 18 months or more in advance if time allows." – Aalap Shah, Managing Director, Pearl Meyer

Transitioning from sporadic private equity grants to a structured annual grant system creates a steady incentive for executives to remain with the company. Conducting a retention audit can help identify potential risks of wealth-triggered departures, enabling the company to address gaps with new unvested awards.

Succession planning should go beyond simple replacement strategies. It should be treated as a strategic initiative to ensure continuity in leadership. An independent compensation committee can oversee these programs, aligning them with shareholder expectations and regulatory requirements. Additionally, securing shareholder approval for share reserve increases and evergreen provisions is often easier to achieve before the IPO than after the company goes public. These proactive measures reinforce leadership readiness and stability during the IPO process.

Board of Directors Structure and Independence

A strong, independent board is as essential to IPO preparation as a skilled C-Suite team. It plays a key role in ensuring the company can meet the expectations of public market discipline. Both the NYSE and Nasdaq mandate that a majority of the board must be independent within 12 months of the IPO. To qualify as independent, a director cannot have received more than $120,000 in annual compensation in the past three years or served as an executive within a three-year "cooling-off" period.

"Make sure you're behaving like a public company before you're a public company." – Bonnie Hyun, US Head of Capital Markets, NYSE

To prepare effectively, companies should recruit independent directors and establish governance practices at least three years before going public. This gives new board members time to gain a deep understanding of the business and set up robust oversight processes before facing the heightened scrutiny of public markets.

Independent Director Representation

When a company goes public, it must ensure its committees meet independence requirements on a strict timeline. Initially, each committee must include at least one independent director. Within 90 days, this must grow to a majority, and by the end of 12 months, all committees must be fully independent.

| Requirement | At IPO | Within 90 Days of IPO | Within 12 Months of IPO |

|---|---|---|---|

| Board Composition | - | - | Majority independent members |

| Audit Committee | At least 1 independent | Majority independent | Fully independent |

| Compensation Committee | At least 1 independent | Majority independent | Fully independent |

| Nominating Committee | At least 1 independent | Majority independent | Fully independent |

Some companies, known as "controlled companies", hold an exemption from majority independent board requirements if more than 50% of voting power is controlled by an individual or group. However, if this status changes after the IPO, the company must comply with the standard rules for board independence.

Industry Knowledge and Public Company Background

Independence alone isn’t enough. Board members need expertise that aligns with the company’s strategic goals. A skills matrix can help identify gaps by mapping existing board capabilities against the company’s needs. This often includes traditional competencies like finance and industry knowledge, as well as newer areas like cybersecurity, artificial intelligence, and ESG.

Boards are increasingly prioritizing directors with expertise in modern challenges such as customer trust, corporate responsibility, and digital transformation. The demand for "digital expertise" has grown as companies navigate technological shifts. To ensure new independent directors are ready for the demands of public company governance, a 3-to-6-month onboarding program is recommended. This program should cover financial literacy, SEC compliance, and fiduciary duties. Pairing new directors with experienced mentors can further ease the transition and help them adapt to their roles effectively.

These steps naturally lead to the formation of strong board committees that maintain oversight and accountability.

Board Committees and Oversight Functions

Public companies must establish three essential committees, each with clearly defined responsibilities:

- Audit Committee: This committee ensures the accuracy of financial statements, oversees internal audits, and manages whistleblower procedures. It must include at least one member who qualifies as an "audit committee financial expert" under Regulation S-K, meaning they have advanced accounting or financial management expertise.

- Compensation Committee: Responsible for setting executive pay, bonuses, and equity policies, this committee also reviews how corporate performance aligns with executive compensation.

- Nominating/Corporate Governance Committee: This group identifies and recruits qualified director candidates, develops governance guidelines, and selects nominees for shareholder meetings. While the NYSE requires this committee to be fully independent, Nasdaq allows director nominations to be approved by a majority of independent directors without requiring a formal committee.

"The Audit Committee, in particular, will have a greatly expanded role following the IPO, and many Audit Committee members are reluctant to sit on multiple committees." – Orrick

To prepare for public company requirements, internal reviews - such as quarterly earnings processes - should be implemented before the IPO. Annual board evaluations are also essential, as they help refine the skills matrix and ensure the board remains equipped to handle new challenges and meet the company’s evolving strategic goals.

Financial and Operational Controls Readiness

Once a strong leadership team is in place, the next step toward going public requires solid financial and operational controls. These systems are the backbone of meeting the demands of public market discipline.

To prepare for the transition to public reporting, a company’s financial and operational systems must be capable of withstanding regulatory scrutiny while delivering accurate and timely financial information. Public companies are required to file quarterly reports (10-Q) and annual reports (10-K) within strict deadlines, often just weeks after the fiscal quarter ends. This leaves no margin for error.

The IPO process itself typically takes 12 to 18 months to complete. Interestingly, fewer than 10% of companies using professional IPO readiness tools find themselves fully prepared for the transition. This highlights the importance of starting early. Leadership must ensure that internal controls, audit systems, and reporting frameworks align with the standards set by the SEC and the Public Company Accounting Oversight Board (PCAOB).

Internal Control Frameworks and Compliance Systems

Public companies are required to implement the COSO framework to meet SEC standards under the Sarbanes-Oxley Act (SOX). Specifically, compliance with SOX Section 404 is mandatory and often involves adopting new systems, refining processes, and hiring internal audit specialists.

"By starting SOX efforts well in advance of a targeted exit date, CFOs empower themselves and their teams to uncover potential material weaknesses early, effectively communicate those findings to the audit committee chair and board of directors, and buy themselves sufficient time to properly address them." – AuditBoard

To meet SOX requirements, companies should begin preparation 12 to 18 months before the planned IPO date. This allows enough time to identify and address potential material weaknesses. Internal Control over Financial Reporting (ICFR) must be robust, capable of detecting issues early, and any weaknesses should be promptly reported to the audit committee and board. Conducting a thorough gap analysis is essential to uncover vulnerabilities in critical areas such as revenue recognition, payroll, and procurement. Additionally, implementing strong IT General Controls (ITGC) ensures the security of financial systems and manages user access effectively.

Once these internal controls are established, rigorous audit processes are the next priority.

Audit Readiness and SEC Compliance

Financial audits must adhere to PCAOB standards, and the SEC generally requires companies to provide 2 to 3 years of audited financials. This often means revising historical financial data to align with public reporting requirements, such as segment reporting, earnings per share calculations, and revenue disaggregation.

"The IPOs that perform poorly in the market are often companies that under-deliver on expectations early in their tenure as public companies." – Jeff Jordan, General Partner, Andreessen Horowitz

To avoid this pitfall, companies can simulate analyst questions to strengthen their quarterly review processes. Following the Statement on Auditing Standards (SAS) 100 guidance for quarterly reviews helps establish the rigor needed for public reporting well before the IPO.

It’s also important to get the national office of the company’s accounting firm to approve planned accounting treatments early. These decisions often undergo scrutiny during the S-1 filing process, so early sign-off can help avoid last-minute surprises.

Documentation and Reporting Systems

Strong internal controls and audit processes must be supported by scalable documentation and reporting systems. Enterprise Resource Planning (ERP) systems that can handle increased transaction volumes and complex reporting requirements are critical for meeting SEC deadlines. Companies should assess whether their current financial software is up to the task. If not, upgrading to public-ready ERP systems is essential - a process that can take 9 to 18 months.

AI-powered tools are increasingly being used to streamline financial operations. These tools enable continuous transaction monitoring and automated reconciliation, reducing the risk of errors and better supporting the rigorous reporting standards of public companies. Additionally, establishing an IPO Project Management Office (PMO) can help oversee reporting, governance, and legal challenges, ensuring a smoother process.

Operational controls must also include disaster recovery, business continuity, and cybersecurity plans. Companies should document every financial process - from revenue recognition to expense approvals - and map these processes to specific controls. This approach ensures accountability and provides a clear roadmap for audit readiness.

Investor Relations and Market Positioning Preparedness

Once your financial and operational controls are solid, the next big task is making sure your leadership team can effectively communicate this strength to the market. With these controls in place, the CEO and CFO need to clearly present the company’s value to investors, ensuring a strong valuation and steady performance after the IPO.

Building an investor relations (IR) team is a critical step. This team can be managed internally, outsourced, or handled through a mix of both. Their role includes shaping the company’s investment thesis, identifying the target investor audience, and managing perceptions in the market after going public. For context, 70% of public company CFOs provide quarterly earnings guidance. This highlights just how important a well-structured IR team is in maintaining investor trust.

Investor Relations Leadership

A successful IR program starts with skilled professionals who can handle the intense scrutiny of public markets. The IR team collaborates closely with financial advisors and legal experts to manage communication with analysts and institutional investors. After the IPO, the CFO often spends more time than the CEO engaging with analysts, especially during earnings seasons.

To prepare, companies should begin building relationships and conducting "test-the-waters" meetings at least a year before officially filing. These meetings, permitted by the SEC, allow companies to gauge market interest and fine-tune their messaging before the formal roadshow. Running mock quarterly earnings calls, complete with tough Q&A sessions involving private investors, can also help uncover potential weaknesses in the company’s narrative.

Growth Narrative and Messaging

The CEO plays a key role in presenting the company’s story - explaining its purpose, how it addresses specific challenges, and what sets it apart from competitors. This narrative should be backed by a handful of meaningful KPIs, such as revenue growth rate, customer acquisition cost, and churn rate.

For tech companies, public investors typically expect revenue growth to exceed 30% within two years of the IPO. Additionally, reaching a "revenue at scale" benchmark of around $100 million is often seen as a critical milestone. Rather than overwhelming analysts with too many metrics, focus on a few that have the most impact. Consistency in messaging is also vital, and the Chief Marketing Officer must ensure that the brand message aligns across all investor-facing materials.

For instance, companies that have successfully gone public often achieved this by controlling expense growth and building strong relationships with investment bankers well before the IPO. Once the growth story is clear, strengthening relationships with analysts can further enhance market credibility.

Analyst Relationships and Market Credibility

Building credibility begins with establishing a track record of delivering on promises made to investors 1–2 years before filing. Missing early forecasts can harm a company’s reputation, leading to a drop in valuation and increased stock volatility. Interestingly, revenue growth tends to have twice the impact on valuation compared to margin improvements, making it critical to demonstrate steady and predictable revenue acceleration.

A "beat and raise" strategy - where companies reserve key initiatives to exceed analyst expectations - can be highly effective. Additionally, ensure the corporate website is ready for public viewing, with clear financial highlights, leadership profiles, and governance details. Participating in "bus tours" organized by bankers 12–24 months before the IPO is another effective way to educate potential investors about the business model.

Conclusion: Ensuring Leadership is IPO-Ready

For a company gearing up to go public, rock-solid leadership is non-negotiable. Success starts with a CFO who’s more than just a numbers person - they need to be a strategic thinker. Add to that a board packed with independent directors experienced in public company governance, and you’ve got a solid base. As Bonnie Hyun, US Head of Capital Markets at NYSE, aptly states:

"Make sure you're behaving like a public company before you're a public company".

This mindset is crucial because the demands don’t ease up after the IPO. Stability in leadership builds trust with investors, and any hiccup - like a CFO leaving right after the IPO - can shake confidence. Companies that prepare rigorously, such as running mock earnings calls and tightening their forecasting processes, are better equipped to handle the "beat and raise" expectations that public markets demand.

Take SpaceX as an example. With buzz around a potential IPO in 2026 and a valuation target of $1.5 trillion, it’s essential to look beyond the headlines. Does the finance team extend beyond the CFO? Has the board evolved from a venture-heavy group to one with independent oversight? Can the company close its books and report earnings within weeks? These are the benchmarks that separate readiness from risk.

Companies that meet these high standards set themselves up for long-term success. They consistently exceed market expectations, backed by strategic initiatives, a well-structured cap table, and accurate, timely financial reporting. For those eyeing pre-IPO investments, digging into these details is key. Resources like the SpaceX Stock Investment Guide can provide the insights needed to make informed decisions.

FAQs

Why should a company hire a CFO at least 18 months before going public?

Hiring a CFO at least 18 months before an IPO is a smart move to ensure the company is ready to tackle the demanding financial and regulatory hurdles of going public. This lead time gives the CFO the opportunity to set up SEC-compliant reporting, establish strong internal controls, and develop reliable financial systems - key elements for a seamless IPO process.

Preparing for an IPO typically takes 12 to 18 months of focused effort. Bringing a CFO on board early ensures there’s enough time to identify and resolve potential challenges while aligning the company’s financial operations with what investors expect. The right CFO can play a pivotal role in setting the stage for a successful IPO.

What role do lock-up agreements play in stabilizing stock prices after an IPO?

Lock-up agreements are designed to temporarily restrict company insiders - like executives and early investors - from selling their shares after an IPO. Typically lasting about 180 days, these agreements aim to limit the number of shares flooding the market too soon, which could otherwise lead to sharp price drops.

By holding off insider sales, these agreements create a more stable trading environment during the early days of public trading. This stability gives the market time to adjust to the new stock without the disruption of large sell-offs, benefiting both the company and its investors as they navigate the critical post-IPO phase.

Why is board independence important for IPO preparation?

Board independence plays a key role in maintaining strong governance, earning investor trust, and adhering to regulatory standards. Both the SEC and major stock exchanges mandate that boards consist of a majority of independent members, alongside fully independent audit, compensation, and nominating committees. This setup not only ensures compliance but also signals a commitment to transparency and accountability - qualities that are essential for a successful IPO.

Comments ()