Board Decision-Making: Pre-IPO vs. Post-IPO

Compare how boards operate before and after an IPO - from fast, insider-driven decisions to formal, compliance-focused governance and independent directors.

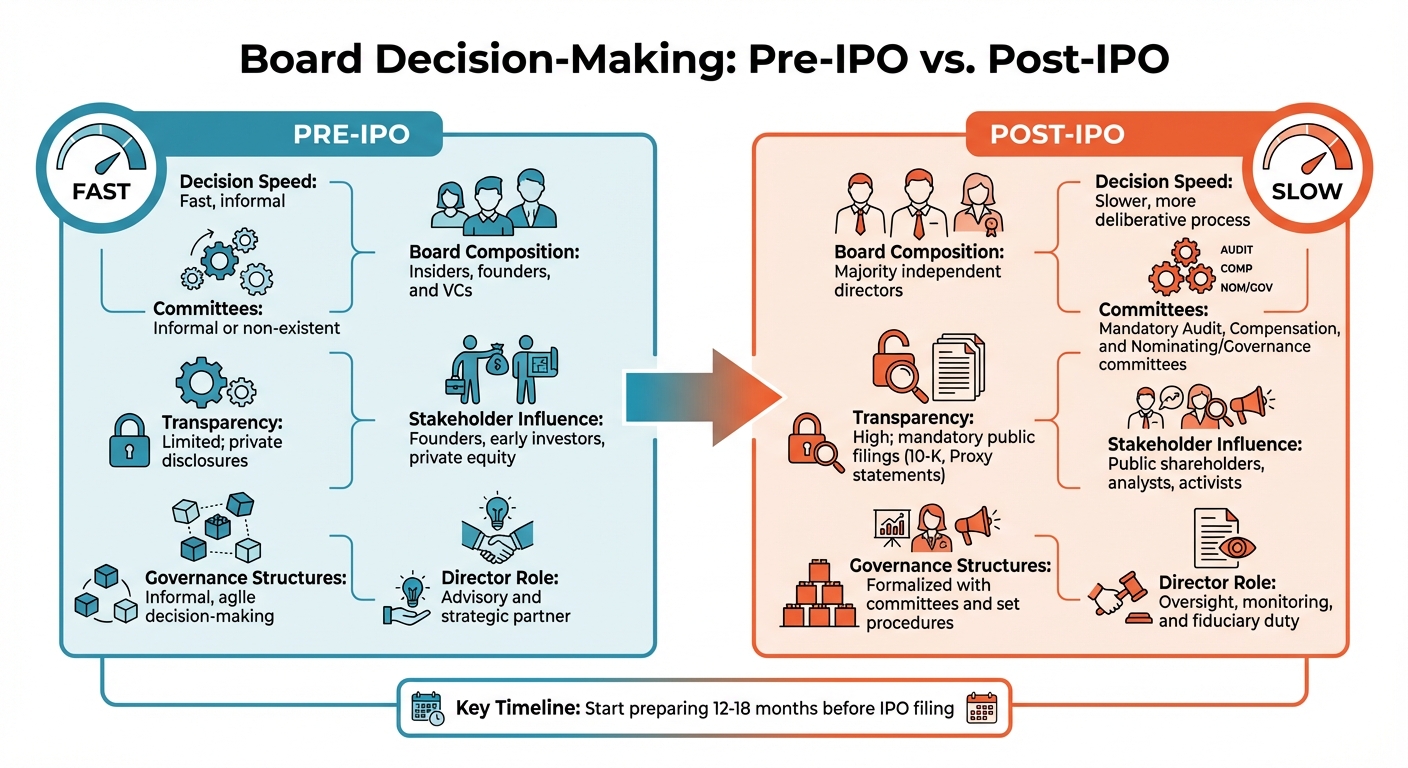

When a company transitions from private to public, its board undergoes a major transformation. Pre-IPO boards focus on growth, speed, and agility, often with informal structures and insider-driven decisions. Post-IPO boards face stricter regulations, greater accountability, and the need to balance shareholder interests. Here's a quick breakdown of the key differences:

-

Pre-IPO Boards:

- Prioritize growth and IPO readiness.

- Decisions are fast and informal.

- Boards are often made up of founders, early investors, and venture capitalists.

- Minimal regulatory and independence requirements.

-

Post-IPO Boards:

- Focus on compliance, risk management, and shareholder value.

- Decisions follow formal processes with defined committees.

- Majority of directors must be independent within a year.

- Must adhere to SEC rules and manage public disclosures.

Quick Comparison:

| Aspect | Pre-IPO | Post-IPO |

|---|---|---|

| Focus | Growth, IPO preparation | Compliance, shareholder value |

| Decision Speed | Fast, informal | Slower, formal processes |

| Board Composition | Insiders, VCs | Majority independent |

| Committees | Informal or none | Mandatory (Audit, etc.) |

| Transparency | Private | Public disclosures required |

The shift from private to public governance requires early preparation, structured processes, and a more diverse and independent board to meet public market expectations. Starting early ensures smoother transitions and better valuation outcomes.

Pre-IPO vs Post-IPO Board Decision-Making Comparison

Board Decision-Making Before an IPO

Focus on Growth and IPO Preparation

In the months leading up to an IPO - typically 6 to 18 months - boards juggle two critical priorities: driving growth and preparing for the rigorous demands of going public. A key part of this preparation involves achieving Sarbanes-Oxley (SOX) compliance, particularly with Section 302 (CEO/CFO certifications) and Section 404 (internal control assessments). At the same time, boards must ensure the company builds the infrastructure that public investors expect.

"Don't delay; start early because there's a lot to do in a compact window." - Maureen Bujno, Managing Director, Deloitte's Center for Board Effectiveness

As the IPO draws closer, the board's responsibilities expand. They shift from primarily advising the CEO to providing strategic oversight and guidance for management. This often includes adopting tools like board portals and governance management platforms 12 to 18 months before filing the S-1. These tools help create an auditable record of decisions, a necessity for public companies. Another critical step is securing Directors and Officers (D&O) liability insurance well in advance to address the heightened personal liability risks that come with being a public company director.

This period of preparation also brings significant changes to the board's structure and membership, aligning it with the expectations of public investors.

Board Structure and Membership

The composition of pre-IPO boards undergoes a major transformation. Early-stage boards, often dominated by founders, venture capitalists, and early investors, must evolve to meet strict independence standards. By the time of the IPO, committees need at least one independent member. Within 90 days, a majority of committee members must be independent, and within 12 months, the entire board and its committees are required to meet full independence standards.

The demand for directors with specialized expertise is also growing. For instance, 58% of public company boards now include at least one director with cybersecurity experience. Beyond cybersecurity, boards are increasingly recruiting members with knowledge in areas like AI governance and ESG. The Audit Committee, in particular, must include at least one "financial expert" as defined by SEC guidelines. To address these needs, boards often use a skills matrix to identify gaps and align recruitment efforts with the company’s long-term strategy.

Attracting skilled, independent directors also requires competitive compensation packages that typically include cash retainers and equity. Additionally, diversity - across gender, racial, and ethnic lines - has become a key focus, driven by expectations from institutional investors and proxy advisors.

How Decisions Are Made

In the early stages of IPO preparation, decision-making tends to prioritize speed and flexibility over formal processes. However, as the IPO approaches, boards begin to adopt more structured governance practices. This includes establishing the three mandatory standing committees - Audit, Compensation, and Nominating/Governance - which handle detailed reviews of financial performance, risk management, and compliance. This allows the full board to focus on broader growth strategies.

The transition to a public-company mindset involves formalizing operations. Boards start using standardized meeting packages, detailed agendas, and pre-read materials that mirror the practices of public companies. Directors are encouraged to rehearse board and committee meetings at a public company pace for at least six months before the IPO. This helps identify operational blind spots and ensures that each committee operates with clearly defined roles outlined in formal charters.

"Make sure you're behaving like a public company before you're a public company." - Bonnie Hyun, US Head of Capital Markets, NYSE

Board Decision-Making After an IPO

Regulatory Requirements and Accountability

Once a company goes public, its board must shift from a growth-driven mindset to a highly regulated and accountable framework. This transition involves adhering to strict SEC rules, including timely filings like Form 10-K, 10-Q, and 8-K, with directors facing personal liability for compliance failures.

Public boards are also required to establish three key committees - Audit, Compensation, and Nominating/Corporate Governance - all operating under formal written charters. The Audit Committee, in particular, faces heightened scrutiny. It must include at least three financially literate members, one of whom qualifies as an "audit committee financial expert." These members must meet strict independence standards, meaning they cannot receive any compensation beyond their board role. The table below outlines the timeline for meeting these independence requirements.

Regulation FD (Fair Disclosure) adds another layer of complexity to board communications. It mandates that all material information be shared with investors simultaneously, eliminating selective disclosures to analysts or institutional investors. Independent directors must also hold regular executive sessions without management present to maintain impartial oversight.

Attendance is another critical aspect of accountability. BlackRock, for example, considers attendance below 75% of board and committee meetings as poor performance, emphasizing the importance of consistent participation.

"Sound governance is critical to the success of a company, the protection of investors' interests, and long-term financial value creation."

- BlackRock Investment Stewardship

Directors are also bound by the Duty of Care, which requires them to be well-informed before making decisions. This often involves consulting legal and financial advisors and conducting thorough investigations - far more rigorous than the oversight typically seen in private companies.

Beyond meeting regulatory requirements, public boards must also navigate the expectations of a diverse group of stakeholders.

Managing Multiple Stakeholder Groups

Public boards must balance the interests of institutional investors, retail shareholders, analysts, proxy advisors, and employees. For instance, in 2018, U.S. institutional investors managing $12 trillion in assets applied sustainable investing criteria, representing about 25% of all professionally managed assets in the country. This trend has pushed boards to address Environmental, Social, and Governance (ESG) issues like climate change, pay equity, and human rights.

Proxy advisory firms such as ISS and Glass Lewis wield significant influence over director elections and executive compensation. To increase accountability, over 90% of S&P 500 companies now have unclassified boards, where directors are elected annually. Pressure to diversify board membership has also grown, with institutional investors advocating for at least 30% diversity among directors.

When stakeholder interests conflict, boards use mechanisms like approvals by disinterested directors, independent committees for transaction reviews, or direct shareholder votes. Some states even allow directors to consider the interests of employees, customers, and communities alongside shareholders through "constituency statutes".

"Noses in, fingers out."

This phrase reminds directors to stay informed and provide guidance without interfering in daily operations. On average, public company boards include around 9 directors for Russell 3000 companies and 11 directors for S&P 500 companies, reflecting the need for diverse expertise to address these varied challenges.

To tackle these responsibilities, boards rely on structured governance processes post-IPO.

Structured Governance Processes

After an IPO, boards transition to a more formal and structured approach to governance. Meetings follow strict schedules, with detailed agendas and meeting packages to keep directors informed. Despite this, only 42% of boards actively shape transaction strategies, highlighting a gap that structured oversight must address.

Board committees take on specialized tasks. The Audit Committee engages with auditors and manages whistleblower policies. The Compensation Committee oversees executive pay and "Say on Pay" votes, while the Nominating/Governance Committee handles board evaluations and refreshment. This division of labor allows the full board to focus on strategic decisions while ensuring critical areas receive thorough review.

| Requirement | At Time of IPO | Within 90 Days | Within 12 Months |

|---|---|---|---|

| Board Independence | No majority required | No majority required | Majority must be independent |

| Audit Committee | At least 1 independent member | Majority independent | Fully independent (min. 3 members) |

| Compensation Committee | At least 1 independent member | Majority independent | Fully independent |

| Nominating Committee | At least 1 independent member | Majority independent | Fully independent |

Public boards also adopt governance technology, such as board portals and entity management software, to maintain digital audit trails for SOX compliance. Additionally, formal codes of ethics and whistleblower programs are implemented to meet transparency requirements. These measures ensure boards operate with the documentation and accountability that public investors expect.

"Being on a board is about realism and not perfection. Many directors are afraid to say when they don't know something - and this needs to change."

- Anastassia Lauterbach, Board Director

GT Risk Week 2025 | Podcast on 'Ringing the Bell: Lessons from IPO Journeys'

Main Differences in Decision-Making: Pre-IPO vs. Post-IPO

When a company transitions from private to public, the way its board operates undergoes a dramatic shift. Pre-IPO boards are all about speed and adaptability. Decisions are often made informally, with founders and early investors steering the direction. But once a company goes public, the board must juggle the interests of a broader range of stakeholders while adhering to strict regulatory guidelines. This shift can slow decision-making but ensures a higher level of oversight.

One of the biggest changes is how quickly decisions are made. Private company boards can move fast, often resolving issues through casual discussions or email votes. Public company boards, on the other hand, need to follow formal processes, involving specialized committees with defined charters. While this adds layers to the process, it also strengthens control and accountability.

Another major difference lies in the board's makeup. Pre-IPO boards are typically filled with insiders, including founders and early investors. After going public, the board must meet specific independence requirements. At least one independent director is required at the IPO stage, a majority within 90 days, and full compliance within a year.

Accountability also transforms significantly. Private boards answer to a small circle of private investors and can keep strategic discussions confidential. Public boards, however, are accountable to institutional investors, retail shareholders, analysts, and proxy advisors. They must also comply with SEC disclosure rules and Regulation FD, which prohibits selective sharing of information.

The table below highlights these key differences.

Comparison Table: Pre-IPO vs. Post-IPO Decision-Making

| Aspect | Pre-IPO | Post-IPO |

|---|---|---|

| Primary Focus | Growth, funding, and IPO readiness | Compliance, risk management, and shareholder value |

| Stakeholder Influence | Founders, early investors, private equity | Public shareholders, analysts, activists |

| Governance Structures | Informal, agile decision-making | Formalized with committees and set procedures |

| Decision Velocity | Faster, fewer layers of approval | Slower, more deliberative process |

| Board Composition | Insiders, founders, and VCs | Majority independent directors |

| Committees | Informal or non-existent | Mandatory Audit, Compensation, and Nominating/Governance committees |

| Transparency | Limited; private disclosures | High; mandatory public filings (e.g., 10-K, Proxy statements) |

| Director Role | Advisory and strategic partner | Oversight, monitoring, and fiduciary duty |

Conclusion

Transitioning from private to public company governance represents a major shift for any board. Before an IPO, boards are typically characterized by agility and quick decision-making, often involving a close-knit group of founders and early investors. After going public, however, the dynamics change dramatically. Boards must operate within a framework shaped by regulatory requirements, heightened public scrutiny, and accountability to a large base of shareholders. Grasping these differences is crucial to navigating the IPO process successfully. It’s a journey from informal, fast-paced decision-making to structured, compliance-driven governance.

Preparation is key to success. Rushing to formalize governance at the last minute can lead to delays, valuation reductions, and extended S-1 reviews. Many boards still fall short in this area, with limited involvement in transaction strategy. This highlights the need to establish solid governance practices well before the IPO process gains momentum.

To overcome these challenges, start adopting public company practices early. This includes forming formal committees 12 to 18 months before filing the S-1, bringing on directors with public company expertise, and practicing quarterly reporting routines. These actions demonstrate operational readiness to institutional investors and can influence your valuation positively.

But governance isn’t just a box to check. As Maureen Bujno aptly puts it:

"Effective governance is a continuous journey".

Your board’s composition, committee structures, and decision-making processes must adapt as your company grows and market conditions shift. Companies that view governance as an ongoing priority - not merely a hurdle to clear for an IPO - are the ones that create enduring value for their shareholders. Starting early and taking a strategic approach to governance lays the foundation for long-term success in the public market.

FAQs

What challenges do boards face when transitioning from private to public governance after an IPO?

Boards encounter several challenges when moving from a private (pre-IPO) to a public (post-IPO) governance structure. A significant obstacle is reorganizing the board to meet regulatory standards. This often includes bringing in independent directors and forming formal committees, such as audit, compensation, and governance committees. To avoid disruptions, this restructuring typically starts well before the IPO process.

Another hurdle is adjusting to new priorities. While pre-IPO boards concentrate on IPO preparation and driving strategic growth, post-IPO boards must tackle stricter compliance requirements, heightened shareholder accountability, and increased market scrutiny. This shift demands adopting more structured governance practices, such as clear disclosures and strict adherence to ethical guidelines. Successfully managing these transitions calls for thorough planning and the ability to adapt to the demands of operating as a public company.

How does a company's board structure change after going public?

When a company transitions to being publicly traded, its board structure usually undergoes significant changes to comply with stricter regulatory and stock exchange standards. Boards often grow in size and shift from being primarily composed of insiders or private equity representatives to having a majority of independent directors.

In addition, formal committees - such as audit, compensation, and governance - are established to promote transparency and ensure compliance. These adjustments help align the board’s responsibilities with shareholder interests and meet the elevated accountability expected of public companies.

Why is it crucial to prepare early for a smooth IPO transition?

Preparing for an IPO well in advance is crucial. It provides the time needed to align the board’s structure with regulatory requirements and governance standards. This process often includes tackling compliance issues, fine-tuning decision-making processes, and building trust with potential investors.

Early preparation also helps avoid last-minute surprises, ensuring the company is ready to handle the increased scrutiny and responsibilities that come with going public. A well-organized board is better equipped to manage this transition smoothly, paving the way for lasting success in the public market.

Comments ()