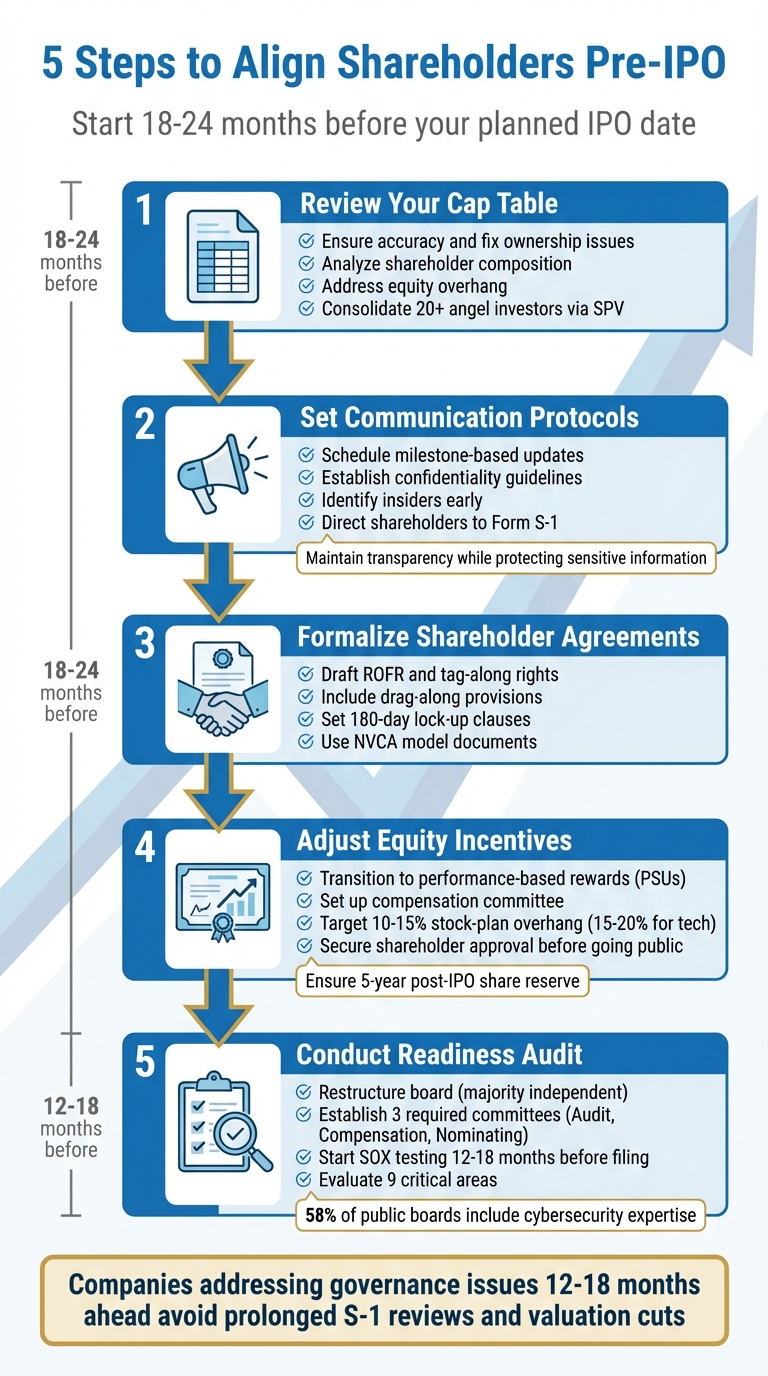

5 Steps to Align Shareholders Pre-IPO

Prepare shareholders for an IPO by cleaning your cap table, setting communication protocols, formalizing agreements, adjusting incentives, and auditing readiness.

Taking your company public? Aligning shareholders is one of the most critical steps to ensure a smooth IPO process. Misaligned interests can lead to disputes, governance issues, and valuation cuts. Here’s how you can prepare effectively:

- Review and tidy up your cap table: Ensure accuracy, address equity overhang, and fix ownership issues 18–24 months before the IPO.

- Set communication protocols: Regular updates and confidentiality guidelines keep everyone informed without compromising sensitive information.

- Formalize shareholder agreements: Draft key agreements like Right of First Refusal (ROFR), drag-along provisions, and lock-up clauses.

- Adjust equity incentives: Simplify your cap table, transition to performance-based rewards, and secure shareholder approval for new plans.

- Conduct a readiness audit: Ensure governance, compliance, and financial systems meet public market standards.

5-Step Process to Align Shareholders Before IPO

Step 1: Review Your Cap Table and Ownership Structure

Your cap table serves as the definitive record of who owns what in your business. Before going public, ensure this document is accurate, up-to-date, and properly reflects ownership. As Promise Legal explains:

"Your cap table is the single source of truth for equity ownership. Investors will scrutinize it before writing checks. Acquirers will demand it during due diligence."

A messy or inaccurate cap table can throw your IPO plans off track. Mistakes might lead to disputes among shareholders, failed due diligence, or even hefty tax penalties for employees - up to a 20% penalty tax plus ordinary income tax and interest on option grants. To avoid these pitfalls, start your review 18 to 24 months before your planned IPO date, giving yourself enough time to fix any issues.

Analyze Shareholder Composition

Once your cap table is in order, take a closer look at its components to spot potential red flags. Create a detailed list of all equity holders, including founders, institutional investors, angel investors, employees with options, and advisors. Be sure to account for your fully diluted share count, which includes all options, warrants, and convertible securities.

If you have more than 20 angel investors, governance can become complicated. In such cases, consider using a Special Purpose Vehicle (SPV) to consolidate smaller investors.

Also, review liquidation preferences. For instance, a 1x preference could create misaligned interests if the IPO valuation falls short of expectations. Running waterfall analyses at various valuation levels can provide insights into how proceeds would be distributed.

Identify Potential Misalignment Risks

Beyond ownership breakdowns, closely examine your equity agreements to prevent misalignment issues. Confirm that all founder and employee equity is tied to four-year vesting schedules with a one-year cliff. Without proper vesting, a departing founder or employee could retain a disproportionate stake, which may create challenges for those staying on as the company heads toward an IPO.

Tackle "dead equity" by updating contact details for former employees or consultants. Formalize any verbal equity promises immediately to avoid potential legal claims under promissory estoppel.

Ensure secondary sales reflect current legal ownership, and carefully track all outstanding SAFEs and convertible notes. This includes monitoring valuation caps and discount rates to understand the dilution impact when these instruments convert. Additionally, review voting rights by share class to assess board control dynamics.

Finally, if you’ve outgrown spreadsheets - typically when you surpass 10 option holders or secure institutional funding - consider upgrading to specialized software like Carta or Pulley. This move can save you from reconstruction costs that can exceed $10,000.

Step 2: Set Up Clear Communication Protocols

Good communication is essential when preparing for an IPO. It helps build trust, avoids misunderstandings, and ensures everyone is on the same page. Without clear guidelines, sensitive information could be accidentally shared, potentially disrupting your timeline. The challenge lies in maintaining transparency while safeguarding confidentiality. These steps build on the clarity established earlier with your cap table, keeping all shareholders aligned as you move through the IPO process.

Provide Regular IPO Progress Updates

To keep all stakeholders informed, schedule updates tied to key milestones, such as filing the S-1, completing audits, or the day of listing. Use these updates to explain critical aspects like 180-day lock-up periods, new regulatory requirements, and the increased compliance workload, including more frequent 409A valuations and quarterly 10-Q reporting. IPO advisory services can help streamline communication between your legal team, transfer agents, and shareholders.

It’s also important to identify "insiders" early in the process. These individuals have specific disclosure obligations that must be included in the S-1 registration statement. Make sure they understand their responsibilities. Additionally, ensure all shareholders accept their securities and update their information, which will make the transition to public transfer agents smoother.

Set Guidelines for Confidential Information

In addition to regular updates, establish strict rules to protect confidential information during the IPO process. The SEC offers a confidential submission process, allowing you to review draft registration statements without exposing them to public scrutiny. However, keep in mind that you’ll need to publicly file your registration statement and all prior drafts at least 15 days before your roadshow begins.

During the quiet period, set clear rules about sharing information. Direct shareholders to the Form S-1 for official details, and schedule large-shareholder meetings outside proxy seasons to avoid triggering additional reporting requirements. The U.S. Securities and Exchange Commission emphasizes:

"It is important to read the prospectus because it provides information regarding the terms of the securities being offered as well as disclosure regarding the company's business, financial condition, management and other matters that are key to deciding whether the offering is a good investment."

At the start of shareholder meetings, ask participants to include a disclaimer stating they are not seeking to change or influence control of the company. This helps them remain eligible to report using the shorter Schedule 13G form and keeps discussions centered on routine updates rather than policy changes.

Step 3: Formalize Shareholder Agreements

Once your communication protocols are in place, the next step is to establish robust legal shareholder agreements. These agreements are essential for protecting your cap table and ensuring smooth decision-making as you prepare for your IPO. Ideally, these documents should be finalized during early funding stages, such as Series A. However, if that hasn’t been done, aim to complete them 18 to 24 months before your planned IPO.

Draft Key Agreements

Start by drafting subscription agreements to regulate the issuance of new shares. Include Right of First Refusal (ROFR) clauses, which require selling shareholders to offer their shares to the company or existing investors first. Add tag-along rights, allowing investors to join a founder’s sale under the same terms.

You’ll also want drag-along provisions to ensure that sales approved by the majority proceed without opposition from minority shareholders. Include lock-up provisions to prevent shareholders from selling their stock for a set period - usually 180 days - after the IPO, helping to stabilize the market. To save on legal fees and ensure your terms align with industry standards, consider using NVCA (National Venture Capital Association) model documents as a foundation.

Address Tender Offer Rules

For pre-IPO tender offers, it’s crucial to establish clear and strict guidelines. These secondary sales can provide liquidity for early employees and investors but must be carefully managed. Set transfer restrictions to prevent sales to competitors or sanctioned parties. Allow limited exceptions for critical needs, such as estate planning. Introduce an oversubscription mechanism to allow existing shareholders to purchase additional shares.

To maintain fairness, implement an annually adjusted fair-price formula for share transfers and buy-backs. Finally, ensure that all shareholder agreements are consistent with your company’s charter, bylaws, and side letters to avoid potential legal setbacks.

Step 4: Adjust Equity Incentives

Fine-tuning your equity incentives can simplify your cap table and align shareholder interests more effectively with your IPO timeline.

Introduce Performance-Based Equity Adjustments

Swap cash bonuses for equity-based compensation like restricted stock, stock bonuses, or stock appreciation rights. Tie these rewards to specific strategic goals such as hitting revenue milestones, expanding into new markets, or achieving profitability targets .

To ensure a structured approach, set up a compensation committee. This team will define your company’s compensation philosophy, determine the right balance between base salary and incentives, and recommend long-term incentive plans (LTIPs). They should also differentiate between performance-based rewards and retention-focused awards. To stay competitive, benchmark your compensation strategy against a peer group of 12–25 public companies with similar revenue, typically ranging from 0.5 to 2 times your company’s size.

"Properly structured performance awards are favored by stockholders, institutional investors and proxy advisory firms and can help to align company executives and other employees with the company's strategy." - Orrick

As you approach your IPO, transition from private-company compensation tools like performance cash plans to performance-based restricted stock units (PSUs) . Be sure to secure stockholder approval for these new plans and any increases to your share reserve before going public . On average, companies preparing for an IPO aim for a stock-plan overhang (the total shares reserved and subject to options) of 10% to 15%. However, tech companies often operate with a slightly higher range of 15% to 20%. Ensure your share reserve can support grants for up to five years post-IPO.

While adjusting equity incentives is key, offering liquidity options can further align shareholder priorities.

Consider Special Purpose Vehicles (SPVs) for Secondary Sales

Special Purpose Vehicles (SPVs) can provide liquidity for early investors and employees without complicating your cap table. These vehicles allow stakeholders to access liquidity in private markets, easing the pressure to go public prematurely. By implementing SPVs, you maintain control over your cap table while offering liquidity to early contributors.

To safeguard your equity structure, enforce strict transfer restrictions to prevent shares from falling into the hands of unwanted parties. Additionally, maintain a "single source of truth" for your cap table to eliminate discrepancies caused by managing multiple versions of data. This ensures clarity and avoids unnecessary complexity as you prepare for your IPO.

Step 5: Conduct a Pre-IPO Readiness Audit

Once shareholders and incentives are aligned, the next step is to ensure your company is fully prepared for the public market through a comprehensive readiness audit. This final check confirms whether you’re ready to meet the demands of going public.

Verify Governance and Compliance

Before filing your S-1, make sure your board structure aligns with public company standards. This includes restructuring your board so that a majority of directors are independent and establishing three required committees: Audit (which must include a financial expert), Compensation, and Nominating/Governance. Interestingly, 58% of public company boards now include at least one director with cybersecurity expertise, which is increasingly expected by the SEC.

To stay ahead, start board restructuring and Sarbanes-Oxley (SOX) testing 12–18 months before filing. Test Internal Controls over Financial Reporting (ICFR) and document certifications for SOX Sections 302 and 404. Additionally, formalize a code of ethics and implement whistleblower programs to show institutional maturity and compliance to regulators.

"Make sure you're behaving like a public company before you're a public company." - Bonnie Hyun, US Head of Capital Markets, NYSE

Your financial statements must also meet Public Company Accounting Oversight Board (PCAOB) standards. Private company audits often fall short of these requirements. Update your systems to handle the SEC’s rigorous reporting standards, including annual (10-K), quarterly (10-Q), and current (8-K) filings. For example, in January 2026, Fenwick assisted BitGo with its $212 million IPO, navigating the strict legal and regulatory hurdles involved in taking a digital asset company public.

Evaluate IPO Viability

Achieving IPO readiness typically involves multiple evaluations. Use your enhanced governance framework as a foundation to assess overall readiness. Bring in third-party experts to evaluate nine critical areas: strategy, financial reporting, systems and controls, legal and governance, tax, financial planning and analysis (FP&A), human capital, sustainability, and divestitures.

Compare your company’s growth and revenue metrics with industry peers to ensure you meet Nasdaq or NYSE listing standards. Investors will be looking for consistent revenue, robust earnings growth, and a compelling market position. If your audit uncovers major gaps, you may need to rethink your timeline. Options like staying private longer, pursuing private equity funding, or exploring mergers and acquisitions could be smarter moves than rushing to market unprepared.

One key insight: Only 42% of boards actively participate in shaping transaction strategies, which highlights an area where many companies fall short. To close this gap, rehearse board meetings for at least six months before the IPO. This practice can help address communication issues and prepare your team for the pressures of running a public company.

Conclusion

Getting shareholders aligned before an IPO isn’t just about checking off tasks - it’s a critical move to protect your company’s valuation and keep your timeline on track. By focusing on five key areas - reviewing your cap table, setting up clear communication protocols, formalizing agreements, refining equity incentives, and conducting a readiness audit - you can create the solid foundation institutional investors expect. Companies that address these governance issues 12–18 months ahead of an IPO often avoid prolonged S-1 review cycles and minimize valuation cuts caused by last-minute due diligence findings.

But the advantages go far beyond the IPO itself. Clear communication and updated equity incentives can ease employee concerns and boost retention during the crucial pre-IPO phase. Additionally, offering private liquidity options like secondary sales or SPVs gives leadership the flexibility to go public when market conditions are favorable, rather than rushing due to internal pressures. This proactive, well-rounded approach doesn’t just streamline the IPO process - it also strengthens your company’s long-term strategy.

"Governance gaps discovered during due diligence create the delays and valuation discounts that derail IPO timelines."

- Nithya B. Das, Chief Legal Officer, Diligent

Recent reports highlight that many companies still struggle with governance issues, making early alignment even more essential. By following these five steps, your business will be well-equipped to meet the challenges of going public.

For exclusive updates on pre-IPO opportunities, private market trends, and insights into private equity, join the SpaceX Stock Investment Guide's free Investor Club at https://spacexstock.com. Connect with a community of investors navigating the dynamic world of private markets.

FAQs

What risks could arise if shareholders aren't aligned before an IPO?

Not getting shareholders on the same page before an IPO can cause some serious headaches. It opens the door to governance conflicts, clashing priorities, or disagreements over equity distribution and decision-making. These kinds of problems can chip away at trust, slow down the IPO process, or even put the entire effort at risk.

On the flip side, when shareholders are aligned, it boosts confidence for potential investors, simplifies the IPO preparation process, and reduces risks that could hurt the company’s valuation or its first steps in the public market.

What are the best practices for communicating with shareholders during the IPO process?

When preparing for an IPO, clear and strategic communication with shareholders is essential. The focus should be on three pillars: transparency, legal compliance, and strategic messaging.

Before filing, it’s critical to avoid making any public statements about the IPO. This helps ensure compliance with securities laws and avoids potential pitfalls like "gun jumping." Once the registration is filed, all communications must be accurate, balanced, and aligned with legal standards. This approach not only builds trust but also establishes credibility with potential investors.

After the company goes public, maintaining open and consistent communication becomes even more important. Tools like earnings calls, regular updates, and roadshows can help keep investors informed and engaged. Tailor your messaging carefully to address the needs of shareholders, regulators, and the media alike. This fosters trust and goodwill, which are invaluable during such a transformative phase.

By planning ahead, adhering to legal guidelines, and prioritizing clear messaging, companies can set the stage for a smooth and successful IPO journey.

Why is a pre-IPO readiness audit important for companies?

Preparing for an IPO is no small feat, and a pre-IPO readiness audit plays a crucial role in ensuring the transition to a publicly traded company goes off without a hitch. This process helps a company meet financial regulations, improve governance practices, and pinpoint any weaknesses in internal controls or reporting systems. Tackling these issues early can save a company from costly delays, fines, or even damage to its reputation during the IPO journey.

Beyond compliance, this audit sends a strong message to potential investors. By showing alignment with key regulatory standards like GAAP and Sarbanes-Oxley, it builds confidence and trust. In essence, a pre-IPO readiness audit sets the stage for a smooth IPO process and positions the company for sustained success in the public market.

Comments ()